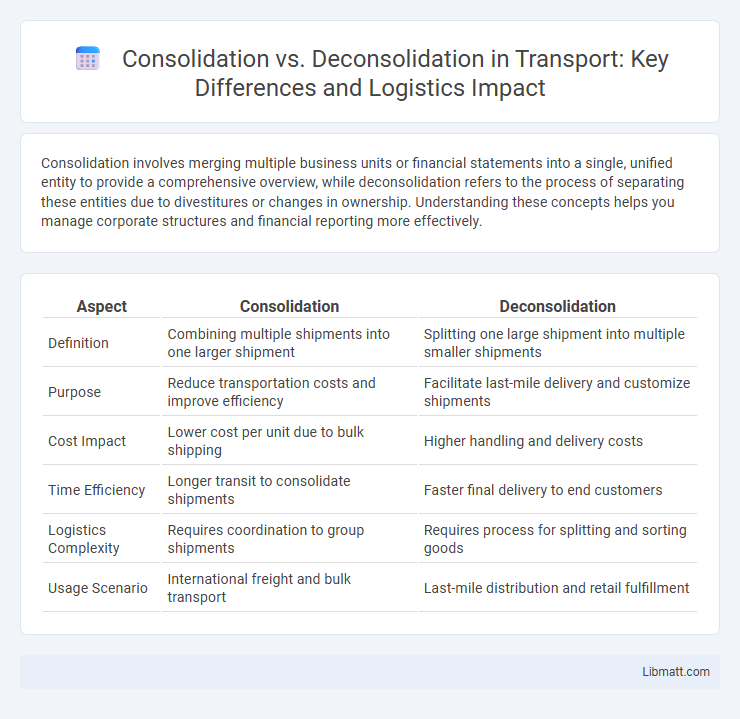

Consolidation involves merging multiple business units or financial statements into a single, unified entity to provide a comprehensive overview, while deconsolidation refers to the process of separating these entities due to divestitures or changes in ownership. Understanding these concepts helps you manage corporate structures and financial reporting more effectively.

Table of Comparison

| Aspect | Consolidation | Deconsolidation |

|---|---|---|

| Definition | Combining multiple shipments into one larger shipment | Splitting one large shipment into multiple smaller shipments |

| Purpose | Reduce transportation costs and improve efficiency | Facilitate last-mile delivery and customize shipments |

| Cost Impact | Lower cost per unit due to bulk shipping | Higher handling and delivery costs |

| Time Efficiency | Longer transit to consolidate shipments | Faster final delivery to end customers |

| Logistics Complexity | Requires coordination to group shipments | Requires process for splitting and sorting goods |

| Usage Scenario | International freight and bulk transport | Last-mile distribution and retail fulfillment |

Introduction to Consolidation and Deconsolidation

Consolidation refers to the process of combining financial statements of a parent company and its subsidiaries into a single, unified report, ensuring a comprehensive view of the entire corporate group's financial position. Deconsolidation occurs when a parent company removes a subsidiary's financials from its consolidated statements, often due to loss of control or disposal of the subsidiary. These accounting practices are governed by standards such as IFRS 10 and ASC 810, which define control criteria and the treatment of financial information during consolidation and deconsolidation events.

Defining Consolidation: Core Concepts

Consolidation involves combining multiple financial statements or data sets from subsidiary companies into a single comprehensive report, reflecting the overall position of a parent company. This process ensures accurate representation of assets, liabilities, revenues, and expenses by eliminating intercompany transactions and balances. Understanding consolidation allows you to assess the true financial health of an enterprise group more effectively.

Understanding Deconsolidation: Key Principles

Deconsolidation involves separating previously combined financial statements of a parent company and its subsidiaries to report them individually, emphasizing the recognition of distinct operational and financial activities. Key principles include accurately identifying control relationships, ensuring proper asset and liability segregation, and maintaining compliance with International Financial Reporting Standards (IFRS 10) or US GAAP guidelines. This process enhances transparency for stakeholders by presenting a clear view of each entity's standalone financial position and performance.

Historical Context: Evolution of Consolidation and Deconsolidation

Consolidation emerged as a dominant strategy during the industrial revolution, enabling companies to achieve economies of scale and streamline operations across growing markets. Over time, deconsolidation gained traction in the late 20th century as businesses sought flexibility, risk reduction, and focus on core competencies by breaking apart large, diversified entities. Your understanding of this historical evolution helps explain why modern enterprises balance between consolidation's efficiency benefits and deconsolidation's agility advantages.

Key Differences Between Consolidation and Deconsolidation

Consolidation combines multiple shipments or data sets into a single entity to reduce costs and improve efficiency, while deconsolidation breaks down that combined entity back into individual components for final delivery or analysis. Key differences include the direction of processing--consolidation aggregates, whereas deconsolidation disaggregates--and their operational objectives, with consolidation focusing on cost savings and deconsolidation on distribution accuracy. These processes impact supply chain logistics, inventory management, and data handling in distinct yet complementary ways.

Advantages and Disadvantages of Consolidation

Consolidation offers advantages such as streamlined financial reporting, improved operational efficiency, and enhanced resource management by combining multiple entities into a single financial statement. Disadvantages include potential loss of autonomy for individual subsidiaries, increased complexity in managing diverse operations, and the risk of obscuring specific entity-level financial performance. Effective consolidation requires careful integration strategies to balance these benefits against the challenges of maintaining transparency and control.

Pros and Cons of Deconsolidation

Deconsolidation offers the advantage of faster shipment processing and reduced transit times by breaking large consolidated loads into smaller, more manageable shipments closer to the destination. However, it can increase handling costs and complexity due to the additional logistical steps required, which may result in higher risks of shipment errors or damage. Your supply chain efficiency depends on balancing these benefits against the potential operational challenges and costs of deconsolidation.

Industry Case Studies: Consolidation vs Deconsolidation

Industry case studies reveal that consolidation frequently enhances operational efficiencies and market share by merging resources and streamlining processes, as seen in telecom and banking sectors where merged entities often achieve cost leadership. Conversely, deconsolidation allows companies to unlock hidden value and improve agility, exemplified by conglomerates spinning off divisions to focus on core competencies and boost shareholder returns. Your strategic decision between consolidation and deconsolidation should consider industry-specific dynamics, competitive pressures, and long-term growth objectives demonstrated in these real-world examples.

Impact on Business Strategy and Operations

Consolidation streamlines business operations by integrating resources, enhancing economies of scale, and strengthening market positioning, which can lead to improved cost efficiency and unified strategic goals. Deconsolidation enables companies to focus on core competencies by divesting non-core assets or subsidiaries, thereby increasing agility and allowing for more targeted operational management. Both processes significantly influence business strategy by either expanding capabilities and market reach or by simplifying structures to foster focused growth and operational flexibility.

Future Trends: Consolidation and Deconsolidation in the Modern Landscape

Future trends in consolidation and deconsolidation emphasize adaptive business models responding to technological advancements and market globalization. Organizations pursuing consolidation seek enhanced efficiency and competitive advantage through mergers, while deconsolidation focuses on agility and niche specialization amid evolving consumer demands. Your strategic choice between these approaches will shape operational resilience and innovation capacity in the rapidly changing economic environment.

consolidation vs deconsolidation Infographic

libmatt.com

libmatt.com