SRECs (Solar Renewable Energy Certificates) specifically represent the environmental attributes of solar energy generation, allowing you to trade credits for solar power production, while RECs (Renewable Energy Certificates) cover a broader range of renewable energy sources such as wind, hydro, and biomass. Understanding the distinction helps you optimize incentives and compliance strategies based on the type of renewable energy involved.

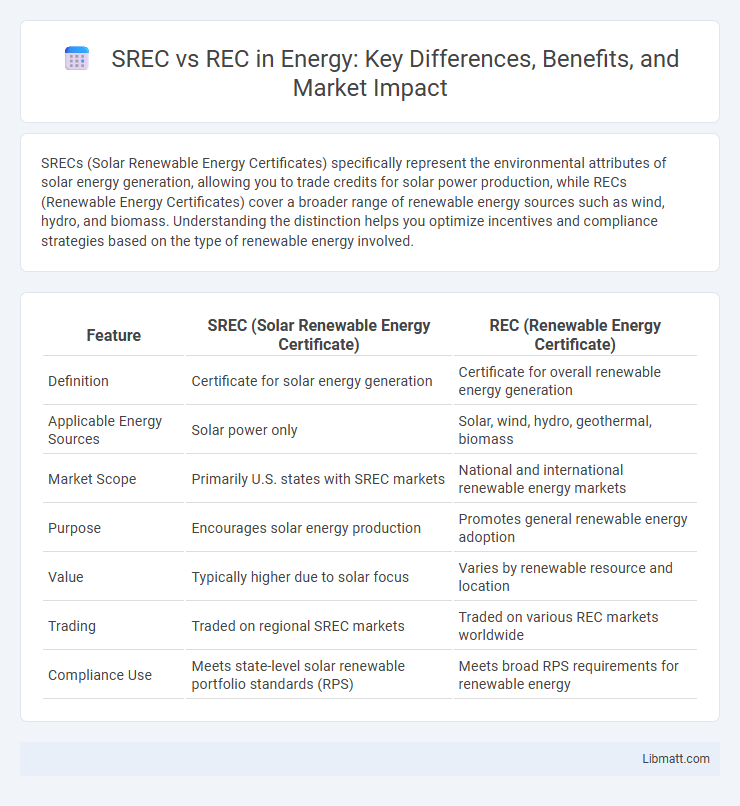

Table of Comparison

| Feature | SREC (Solar Renewable Energy Certificate) | REC (Renewable Energy Certificate) |

|---|---|---|

| Definition | Certificate for solar energy generation | Certificate for overall renewable energy generation |

| Applicable Energy Sources | Solar power only | Solar, wind, hydro, geothermal, biomass |

| Market Scope | Primarily U.S. states with SREC markets | National and international renewable energy markets |

| Purpose | Encourages solar energy production | Promotes general renewable energy adoption |

| Value | Typically higher due to solar focus | Varies by renewable resource and location |

| Trading | Traded on regional SREC markets | Traded on various REC markets worldwide |

| Compliance Use | Meets state-level solar renewable portfolio standards (RPS) | Meets broad RPS requirements for renewable energy |

Introduction: Understanding SREC and REC

SREC (Solar Renewable Energy Certificates) and REC (Renewable Energy Certificates) both represent proof that electricity was generated from renewable sources, but SRECs are specific to solar power while RECs cover a broader range of renewables like wind, hydro, and biomass. These certificates enable solar and renewable energy producers to earn additional revenue by selling credits based on the amount of clean energy their systems generate. Understanding your options between SRECs and RECs can maximize the financial benefits of your renewable energy investment.

What is an SREC?

An SREC (Solar Renewable Energy Certificate) represents the environmental attributes of one megawatt-hour (MWh) of electricity generated from solar energy, used to meet state-specific solar energy goals. Unlike a generic REC, which can come from various renewable sources such as wind or hydro, an SREC specifically verifies solar power production and can be sold or traded to companies needing to comply with solar Renewable Portfolio Standards (RPS). This market-driven instrument incentivizes solar energy development by providing additional revenue streams for solar system owners.

What is a REC?

A Renewable Energy Certificate (REC) represents proof that one megawatt-hour (MWh) of electricity was generated from a renewable energy resource, such as solar, wind, or hydro. RECs serve as tradable commodities that support renewable energy markets by allowing businesses and individuals to claim the environmental benefits of clean energy even if they don't produce it themselves. Your investment in RECs helps drive the adoption of green technologies and meets renewable portfolio standards set by governments.

Key Differences Between SREC and REC

SRECs (Solar Renewable Energy Certificates) specifically represent solar energy production, while RECs (Renewable Energy Certificates) encompass a broader range of renewable energy sources like wind, hydro, and biomass. Each SREC certifies that one megawatt-hour (MWh) of solar electricity was generated, whereas a REC certifies one MWh of renewable electricity, regardless of source. SREC markets and pricing are often influenced by state solar mandates, whereas REC values depend on regional renewable portfolio standards (RPS) and market demand.

How SREC and REC Markets Operate

SREC (Solar Renewable Energy Certificate) markets operate by allowing solar energy producers to earn and trade certificates representing one megawatt-hour of solar-generated electricity, creating financial incentives while meeting state-specific solar mandates. REC (Renewable Energy Certificate) markets encompass a broader range of renewable energy sources such as wind, hydro, and biomass, enabling utilities and companies to comply with renewable portfolio standards through certificate trading. Understanding how both you can trade SRECs or RECs helps maximize returns while supporting the growth of clean energy infrastructure.

Eligibility Requirements for SREC and REC

Eligibility requirements for SRECs (Solar Renewable Energy Credits) mandate that your solar energy system must be connected to the grid and meet specific certification standards set by state regulatory bodies, often requiring metered output verification to ensure solar origin. RECs (Renewable Energy Credits) eligibility encompasses a broader range of renewable sources, such as wind, hydro, and biomass, and typically requires that the renewable energy generation be verified through certified tracking systems like GATS or M-RETS. Both SRECs and RECs require compliance with regional program rules, but SRECs focus exclusively on solar generation while RECs cover diverse renewable technologies.

Benefits of SREC vs REC for Renewable Energy Producers

SREC (Solar Renewable Energy Certificate) offers renewable energy producers a direct financial incentive by allowing the sale of solar-specific credits, often yielding higher market prices compared to general RECs (Renewable Energy Certificates). SRECs provide clearer tracking and valuation for solar energy generation, enabling Your solar projects to generate additional revenue streams and enhance return on investment. The tailored nature of SRECs supports state-level renewable energy goals, offering more targeted benefits compared to the broader applicability of RECs.

Financial Value: SREC vs REC Pricing

Solar Renewable Energy Certificates (SRECs) typically command higher financial value compared to Renewable Energy Certificates (RECs) due to their specific association with solar energy generation, which often benefits from state-mandated solar carve-outs in Renewable Portfolio Standards (RPS). The pricing of SRECs can fluctuate significantly based on regional demand, state policies, and solar capacity targets, frequently ranging from $15 to over $300 per certificate. Conversely, RECs, representing a broader category of renewable energy sources, generally have lower and more stable market prices, often between $1 and $20 per certificate, reflecting less stringent regulatory incentives.

Environmental Impact: SREC vs REC

SRECs (Solar Renewable Energy Certificates) specifically represent the environmental benefits of solar energy generation, directly supporting the reduction of carbon emissions and promoting clean solar power adoption. RECs (Renewable Energy Certificates) encompass a broader range of renewable sources like wind, hydro, and biomass, each contributing to lowering your overall carbon footprint and combating climate change. Choosing SRECs versus general RECs can influence the targeted impact of your renewable energy investment, with SRECs driving solar technology growth while RECs support a diverse renewable energy portfolio.

Choosing the Right Certificate: SREC or REC?

Choosing the right certificate depends on your renewable energy goals and regional regulations, as Solar Renewable Energy Certificates (SRECs) specifically represent solar power generation, while Renewable Energy Certificates (RECs) encompass a broader range of renewable sources including wind, hydro, and biomass. SRECs hold particular value in states with solar carve-out mandates, enabling solar producers to earn premiums by proving solar-specific generation. RECs provide flexibility for companies aiming to meet general renewable energy targets or comply with renewable portfolio standards without a strict solar requirement.

SREC vs REC Infographic

libmatt.com

libmatt.com