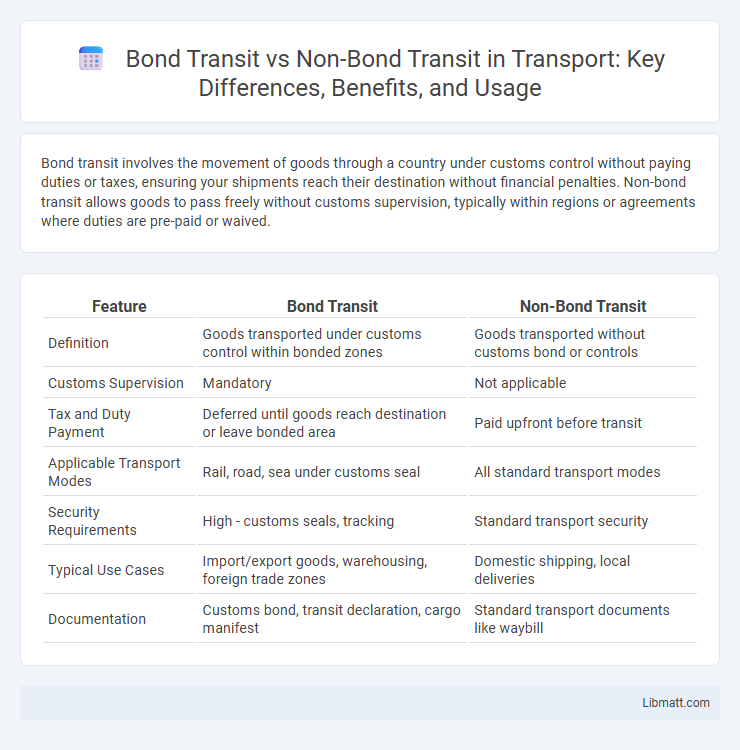

Bond transit involves the movement of goods through a country under customs control without paying duties or taxes, ensuring your shipments reach their destination without financial penalties. Non-bond transit allows goods to pass freely without customs supervision, typically within regions or agreements where duties are pre-paid or waived.

Table of Comparison

| Feature | Bond Transit | Non-Bond Transit |

|---|---|---|

| Definition | Goods transported under customs control within bonded zones | Goods transported without customs bond or controls |

| Customs Supervision | Mandatory | Not applicable |

| Tax and Duty Payment | Deferred until goods reach destination or leave bonded area | Paid upfront before transit |

| Applicable Transport Modes | Rail, road, sea under customs seal | All standard transport modes |

| Security Requirements | High - customs seals, tracking | Standard transport security |

| Typical Use Cases | Import/export goods, warehousing, foreign trade zones | Domestic shipping, local deliveries |

| Documentation | Customs bond, transit declaration, cargo manifest | Standard transport documents like waybill |

Introduction to Bond Transit and Non-Bond Transit

Bond transit refers to the movement of goods under customs control where duties and taxes are suspended until the final destination or customs office. Non-bond transit involves the transportation of goods without customs supervision, often requiring immediate payment of duties and compliance with local regulations. Understanding the key differences between bond transit and non-bond transit helps you manage logistics and customs processes efficiently.

Defining Bond Transit: Key Features

Bond transit refers to the movement of goods under customs control within a bonded area, allowing Your shipments to be transported without paying import duties until they reach their final destination. Key features include secure storage, deferred duty payments, and the ability to transport goods across borders or between warehouses without immediate customs clearance. Non-bond transit involves goods moving without customs supervision, requiring duties to be paid upfront and limiting flexibility in international logistics.

Understanding Non-Bond Transit: Core Concepts

Non-bond transit refers to the movement of goods through a country without entering the customs territory for storage or use, allowing products to pass under customs control without duties or taxes being applied. This process enables faster shipment times by avoiding lengthy customs clearance, crucial for time-sensitive cargo. Unlike bond transit, which involves goods stored in a bonded warehouse until duties are paid, non-bond transit focuses on seamless transfer between countries with minimal customs intervention.

Regulatory Requirements for Bond Transit

Bond transit requires adherence to strict regulatory requirements, including customs declarations, secure container seals, and approved transport routes to ensure goods remain under customs control during movement. Non-bond transit involves fewer regulatory controls, as shipments are not under customs supervision and typically do not mandate detailed customs documentation or security measures. Your compliance with bond transit regulations prevents delays, penalties, and potential seizure of goods at customs checkpoints.

Documentation Needed for Non-Bond Transit

Non-bond transit requires detailed documentation, including a transit manifest, customs declaration, and proof of payment for applicable taxes or duties to ensure compliance with local regulations. You must also provide a clear description of the goods, their origin, destination, and transit route to facilitate smooth customs processing. Accurate documentation is essential to avoid delays and potential penalties during non-bond transit operations.

Customs Procedures: Bond vs Non-Bond Transit

Bond transit allows goods to move under customs control between two points without paying duties or taxes until reaching the final destination, facilitating faster clearance and secure handling. Non-bond transit requires immediate payment of duties or taxes before goods proceed, leading to longer processing times and increased cash flow constraints. Customs procedures for bond transit include using bonded warehouses and detailed documentation to ensure compliance, whereas non-bond transit involves direct customs clearance and payment at each transit point.

Cost Implications: Comparing Transit Methods

Bond transit involves transporting goods through a customs bonded area without immediate duty payment, reducing upfront costs by deferring taxes until goods reach their final destination. Non-bond transit requires immediate duty payment upon entry, which can increase inventory holding costs and impact cash flow for Your business. Choosing bond transit can optimize cost management by minimizing initial outlays and streamlining customs clearance processes.

Risks and Compliance in Bond Transit

Bond transit involves the movement of goods under customs control with a guarantee to ensure duties and taxes are paid, reducing risks associated with smuggling and revenue loss. Non-bond transit lacks such guarantees, increasing exposure to compliance violations, confiscations, and potential penalties for failing to meet customs regulations. Strict adherence to customs documentation and secure cargo handling in bond transit mitigates legal risks and ensures smoother cross-border trade compliance.

Advantages and Disadvantages of Each Transit Type

Bond transit offers advantages such as deferred customs duties and taxes, which improve cash flow for businesses by delaying payments until goods reach their final destination. However, bond transit requires a secured guarantee or bond, leading to additional administrative costs and potential liability if transit conditions are breached. Non-bond transit eliminates the need for such guarantees, simplifying procedures but requiring immediate payment of duties and taxes, which can strain your financial resources.

Choosing the Right Transit Method for Your Shipment

Selecting between bond transit and non-bond transit depends on the nature and urgency of your shipment. Bond transit allows goods to move under customs control without immediate duty payment, ideal for cross-border transport requiring temporary storage or redistribution. Non-bond transit suits shipments with cleared duties or domestic transit only, offering a faster process but limited to goods already in free circulation.

bond transit vs non-bond transit Infographic

libmatt.com

libmatt.com