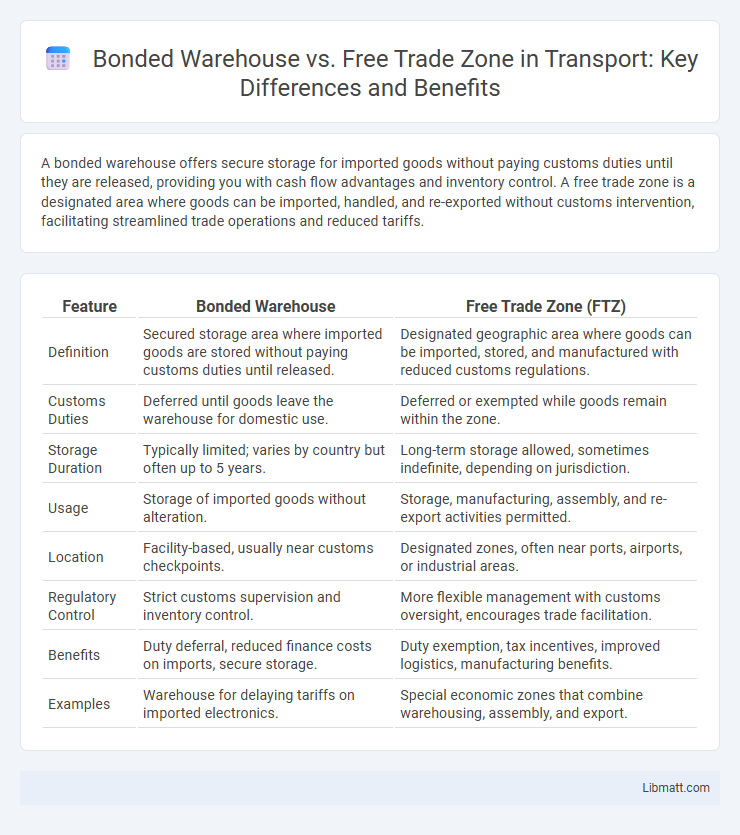

A bonded warehouse offers secure storage for imported goods without paying customs duties until they are released, providing you with cash flow advantages and inventory control. A free trade zone is a designated area where goods can be imported, handled, and re-exported without customs intervention, facilitating streamlined trade operations and reduced tariffs.

Table of Comparison

| Feature | Bonded Warehouse | Free Trade Zone (FTZ) |

|---|---|---|

| Definition | Secured storage area where imported goods are stored without paying customs duties until released. | Designated geographic area where goods can be imported, stored, and manufactured with reduced customs regulations. |

| Customs Duties | Deferred until goods leave the warehouse for domestic use. | Deferred or exempted while goods remain within the zone. |

| Storage Duration | Typically limited; varies by country but often up to 5 years. | Long-term storage allowed, sometimes indefinite, depending on jurisdiction. |

| Usage | Storage of imported goods without alteration. | Storage, manufacturing, assembly, and re-export activities permitted. |

| Location | Facility-based, usually near customs checkpoints. | Designated zones, often near ports, airports, or industrial areas. |

| Regulatory Control | Strict customs supervision and inventory control. | More flexible management with customs oversight, encourages trade facilitation. |

| Benefits | Duty deferral, reduced finance costs on imports, secure storage. | Duty exemption, tax incentives, improved logistics, manufacturing benefits. |

| Examples | Warehouse for delaying tariffs on imported electronics. | Special economic zones that combine warehousing, assembly, and export. |

Introduction to Bonded Warehouses and Free Trade Zones

Bonded warehouses are secure storage facilities where imported goods are held without payment of customs duties until they are released for domestic use or re-export. Free trade zones are designated areas that allow businesses to import, manufacture, and export goods with reduced customs regulations and tax benefits. Understanding the operational differences between bonded warehouses and free trade zones helps optimize your supply chain and reduce logistics costs.

Key Definitions: Bonded Warehouse vs Free Trade Zone

A bonded warehouse is a secured storage facility where imported goods are stored without paying customs duties until they are released for domestic use, allowing companies to defer tax payments. A free trade zone is a designated geographic area where goods can be imported, handled, manufactured, and re-exported without intervention from customs authorities, promoting international trade and reducing export-import barriers. Both facilities enhance supply chain efficiency but differ in their scope, with bonded warehouses primarily focused on storage and duty deferral, while free trade zones facilitate broader trade and manufacturing activities.

Legal Framework and Regulatory Differences

Bonded warehouses operate under customs control where goods are stored without paying import duties until released for domestic use, governed by strict national customs laws and international treaties. Free trade zones (FTZs) function as separate customs territories with more flexible regulations, allowing goods to be imported, handled, and re-exported without customs intervention, subject to specific economic zone statutes. Your choice will depend on whether you prioritize regulatory oversight and duty deferral in bonded warehouses or the operational freedom and incentives provided by FTZs.

Types of Goods Handled in Each Facility

Bonded warehouses primarily handle imported goods subject to customs duties, including raw materials, finished products, and excisable items, allowing storage without immediate tax payment. Free trade zones accommodate a broader range of goods such as imports, exports, and re-exports, facilitating manufacturing, assembly, and redistribution activities with minimal customs intervention. Both facilities support inventory management and trade optimization but differ in customs control and permissible activities.

Customs Procedures and Documentation

Bonded warehouses require detailed customs documentation for goods entering and exiting, including import declarations and customs bonds, ensuring duties are deferred until goods leave the warehouse for domestic use. Free trade zones simplify customs procedures by allowing goods to be stored, processed, or re-exported with minimal customs intervention and fewer documentation requirements, often reducing delays and costs. Both environments aim to facilitate trade but differ significantly in regulatory oversight and the extent of customs controls applied.

Tax Benefits and Cost Implications

Bonded warehouses allow you to defer import duties and taxes until goods are removed for domestic consumption, reducing upfront costs and improving cash flow. Free trade zones typically offer more extensive tax benefits, including exemptions from import/export duties, VAT, and sometimes corporate taxes, lowering overall operational expenses. Choosing between these depends on your specific logistics needs and tax planning strategies.

Storage Time Limits and Flexibility

Bonded warehouses typically impose strict storage time limits regulated by customs authorities, often ranging from 90 days to two years, before goods must be cleared or re-exported. Free trade zones offer significantly greater flexibility, allowing goods to be stored indefinitely without immediate customs duties or time constraints. This extended storage period in free trade zones supports long-term inventory management and reduces pressure on importers to expedite clearance processes.

Import, Export, and Re-export Capabilities

Bonded warehouses allow you to store imported goods without paying customs duties until the goods enter the domestic market, supporting deferred import tax payment and controlled export processes. Free trade zones offer enhanced import, export, and re-export capabilities with reduced customs regulations, enabling businesses to handle international trade more efficiently by allowing goods to enter, be processed, and then re-exported without incurring customs duties. Both structures facilitate global supply chains, but free trade zones provide greater flexibility for re-export operations and processing activities compared to bonded warehouses.

Security Measures and Compliance Standards

Bonded warehouses enforce strict security measures, including controlled access, surveillance, and inventory tracking, ensuring compliance with customs regulations to prevent unauthorized goods movement. Free trade zones implement advanced security protocols and regularly audited compliance standards tailored to facilitate international trade while safeguarding against smuggling and fraud. Your choice between these depends on the level of regulatory oversight and security aligned with your import-export operational needs.

Choosing Between Bonded Warehouse and Free Trade Zone

Choosing between a bonded warehouse and a free trade zone depends on your specific business needs, such as inventory management, customs regulations, and tax benefits. Bonded warehouses offer secure storage for imported goods with deferred customs duties, while free trade zones provide broader operational freedoms including manufacturing and re-export without immediate customs intervention. Assess your supply chain requirements, cost implications, and regulatory compliance to determine which option best supports your international trade strategy.

bonded warehouse vs free trade zone Infographic

libmatt.com

libmatt.com