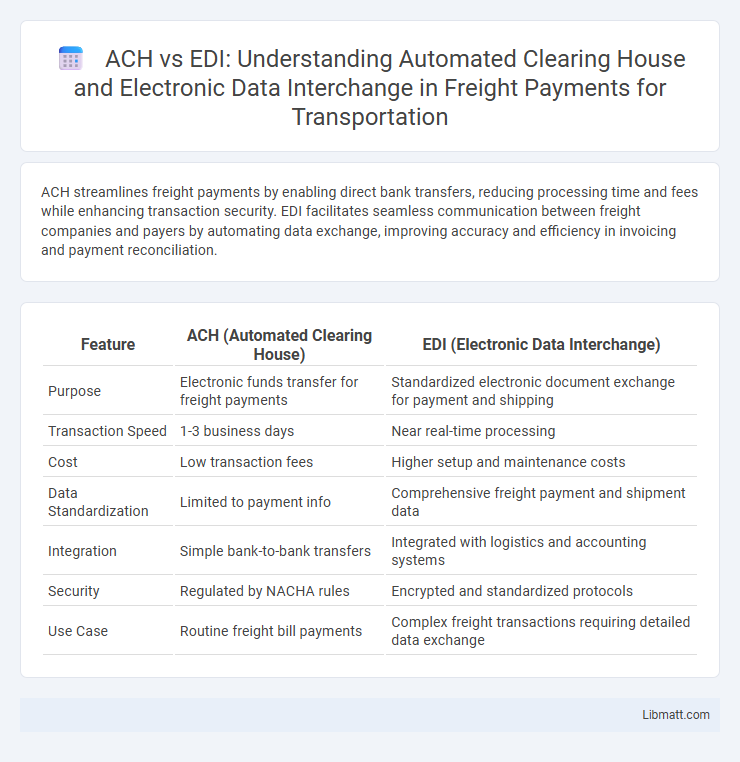

ACH streamlines freight payments by enabling direct bank transfers, reducing processing time and fees while enhancing transaction security. EDI facilitates seamless communication between freight companies and payers by automating data exchange, improving accuracy and efficiency in invoicing and payment reconciliation.

Table of Comparison

| Feature | ACH (Automated Clearing House) | EDI (Electronic Data Interchange) |

|---|---|---|

| Purpose | Electronic funds transfer for freight payments | Standardized electronic document exchange for payment and shipping |

| Transaction Speed | 1-3 business days | Near real-time processing |

| Cost | Low transaction fees | Higher setup and maintenance costs |

| Data Standardization | Limited to payment info | Comprehensive freight payment and shipment data |

| Integration | Simple bank-to-bank transfers | Integrated with logistics and accounting systems |

| Security | Regulated by NACHA rules | Encrypted and standardized protocols |

| Use Case | Routine freight bill payments | Complex freight transactions requiring detailed data exchange |

Introduction to ACH and EDI in Freight Payments

ACH (Automated Clearing House) enables electronic funds transfers for freight payments, facilitating secure, cost-effective, and timely settlements between shippers and carriers. EDI (Electronic Data Interchange) streamlines the exchange of freight payment data, including invoices and shipment details, improving accuracy and reducing manual errors. Your freight payment process benefits from ACH's direct payment capabilities and EDI's automated data communication to enhance overall transaction efficiency.

Understanding the Basics: What is ACH?

ACH (Automated Clearing House) is a secure electronic network used for processing bulk payments and transfers directly between bank accounts, enabling faster and more cost-effective freight payment settlements. It eliminates the need for paper checks, reducing processing errors and improving transaction transparency within supply chain financial operations. ACH is widely adopted in freight payments for its reliability, efficiency, and ability to handle high-volume transactions seamlessly.

Understanding the Basics: What is EDI?

EDI (Electronic Data Interchange) is a standardized digital communication system that enables the secure exchange of business documents, such as invoices, purchase orders, and freight payment details, between trading partners. Unlike ACH, which primarily facilitates electronic funds transfers, EDI focuses on the automation of data exchange to streamline freight payment processing and reduce manual errors. Understanding EDI's role in freight payments helps your business enhance transaction accuracy, speed, and overall operational efficiency.

Key Differences Between ACH and EDI

ACH (Automated Clearing House) facilitates the electronic transfer of funds between banks for freight payments, streamlining cash flow with low processing fees and faster settlement times. EDI (Electronic Data Interchange) focuses on the exchange of standardized business documents such as invoices and payment remittance data, enhancing accuracy and reducing manual entry errors in freight payment processing. While ACH handles the actual movement of money, EDI ensures data integrity and communication efficiency between freight carriers and payers.

Advantages of ACH for Freight Payment Processing

ACH offers faster and more cost-effective freight payment processing compared to EDI, reducing transaction fees and improving cash flow management. Your business benefits from enhanced security and transaction transparency through encrypted ACH transfers, lowering fraud risks inherent in paper checks or manual EDI entries. ACH also simplifies reconciliation with standardized electronic records, streamlining accounting workflows and minimizing payment errors in freight operations.

Benefits of EDI for Freight Payment Transactions

EDI streamlines freight payment transactions by enabling faster and more accurate exchange of standardized payment and shipment data between trading partners. This reduces manual errors, lowers processing costs, and improves cash flow management compared to traditional ACH payments. Your business benefits from enhanced transparency and real-time tracking of payment status, leading to better operational efficiency and supplier relationships.

Security Considerations: ACH vs EDI

ACH transactions utilize encrypted networks and multi-factor authentication to ensure secure fund transfers, reducing the risk of fraud in freight payments. EDI employs standardized protocols with built-in data validation and secure communication channels that protect transaction integrity and prevent unauthorized access. Both systems offer robust security frameworks, but ACH emphasizes bank-level encryption while EDI focuses on comprehensive data standardization and controlled document exchange.

Implementation Challenges and Costs

ACH payments in freight offer lower transaction fees but require rigorous bank account verification and compliance with NACHA rules, posing initial implementation complexity. EDI systems demand significant upfront investment in software integration and ongoing maintenance, alongside training staff to manage standardized electronic data formats for freight payment processing. Your choice depends on balancing the lower cost and simpler setup of ACH against EDI's ability to streamline large-scale, automated freight invoice and payment workflows despite higher initial expenses.

Choosing the Right Solution for Your Freight Business

Choosing the right solution for freight payments depends on transaction volume and integration needs; ACH offers cost-effective, secure electronic bank-to-bank transfers ideal for high-volume, standardized payments, while EDI excels in exchanging detailed, structured freight and payment data across complex supply chains. Freight businesses prioritizing automation and accuracy may benefit from EDI's compatibility with enterprise resource planning (ERP) systems, enabling seamless communication between shippers, carriers, and financial institutions. Evaluating operational scale, speed requirements, and data complexity ensures optimal alignment between ACH's streamlined payments and EDI's comprehensive data interchange capabilities.

Future Trends in Freight Payment Automation

Future trends in freight payment automation emphasize the integration of ACH and EDI systems to streamline transaction efficiency and accuracy. ACH offers cost-effective, automated bank transfers, while EDI facilitates standardized, real-time data exchange between trading partners, reducing manual errors. Leveraging your freight payment processes with hybrid ACH-EDI solutions can enhance transparency, accelerate settlement times, and prepare your operations for increasing demands in digital freight logistics.

ACH (Automated Clearing House) vs EDI (Electronic Data Interchange) in freight payments Infographic

libmatt.com

libmatt.com