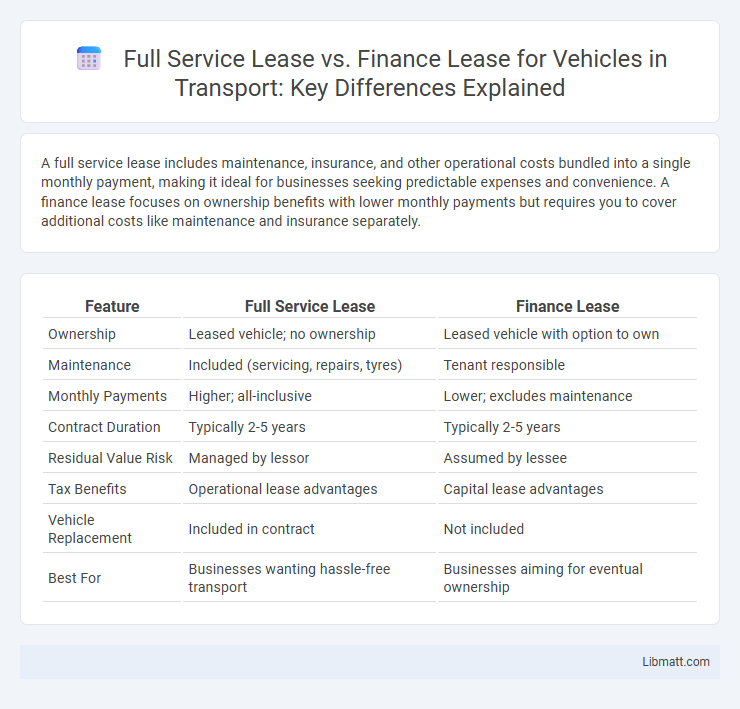

A full service lease includes maintenance, insurance, and other operational costs bundled into a single monthly payment, making it ideal for businesses seeking predictable expenses and convenience. A finance lease focuses on ownership benefits with lower monthly payments but requires you to cover additional costs like maintenance and insurance separately.

Table of Comparison

| Feature | Full Service Lease | Finance Lease |

|---|---|---|

| Ownership | Leased vehicle; no ownership | Leased vehicle with option to own |

| Maintenance | Included (servicing, repairs, tyres) | Tenant responsible |

| Monthly Payments | Higher; all-inclusive | Lower; excludes maintenance |

| Contract Duration | Typically 2-5 years | Typically 2-5 years |

| Residual Value Risk | Managed by lessor | Assumed by lessee |

| Tax Benefits | Operational lease advantages | Capital lease advantages |

| Vehicle Replacement | Included in contract | Not included |

| Best For | Businesses wanting hassle-free transport | Businesses aiming for eventual ownership |

Introduction to Vehicle Leasing Options

Full service leases for vehicles include maintenance, insurance, and roadside assistance within fixed monthly payments, offering comprehensive cost predictability. Finance leases focus primarily on long-term use with lower monthly payments but require lessees to handle maintenance and insurance separately. Choosing between these leasing options depends on budget preferences, desire for hassle-free vehicle management, and anticipated vehicle usage.

What is a Full Service Lease?

A Full Service Lease for vehicles includes not only the use of the car but also covers maintenance, insurance, and road tax, providing a comprehensive, all-inclusive package. This option reduces your administrative burden and unpredictable costs by bundling services into a fixed monthly payment. Full Service Leases are ideal for businesses or individuals seeking hassle-free vehicle management without ownership responsibilities.

Understanding Finance Lease for Vehicles

A finance lease for vehicles involves the lessee making payments over a fixed term, covering the cost of the vehicle plus interest, without ownership until the lease ends. This type of lease typically includes lower monthly payments compared to outright purchase, but the lessee is responsible for maintenance, insurance, and other running costs. Understanding key terms such as residual value, lease term, and finance charges is crucial for evaluating the total cost and benefits of a finance lease.

Key Differences Between Full Service and Finance Lease

Full service leases include maintenance, insurance, and service costs bundled into fixed monthly payments, while finance leases typically cover only the use of the vehicle with additional expenses borne by you. Ownership remains with the leasing company in both options, but full service leases offer greater convenience by managing upkeep, reducing your administrative responsibilities. Key differences lie in cost structure, responsibility for vehicle care, and the level of service provided throughout the lease term.

Cost Comparison: Full Service Lease vs Finance Lease

A full service lease typically includes maintenance, insurance, and roadside assistance within fixed monthly payments, resulting in higher upfront costs but fewer unexpected expenses over time. Finance leases generally have lower monthly payments but require you to manage maintenance, insurance, and potential repair costs separately, which can increase your overall expenditure. Evaluating your budget and risk tolerance helps determine whether a predictable all-in cost of a full service lease or the potentially lower but variable costs of a finance lease better suit your needs.

Maintenance and Servicing: What’s Included?

Full service leases for vehicles typically include comprehensive maintenance and servicing packages, covering routine inspections, oil changes, tire replacements, and repairs as part of the agreement. Finance leases usually exclude these services, requiring the lessee to handle and pay for all maintenance and servicing costs independently. Choosing a full service lease ensures predictable expenses and hassle-free upkeep, while finance leases offer lower upfront costs but greater responsibility for vehicle care.

Flexibility and End-of-Term Options

Full service leases offer greater flexibility by including maintenance, insurance, and roadside assistance, allowing you to manage all vehicle-related expenses under a single monthly payment. End-of-term options in full service leases typically include vehicle return, renewal, or purchase, providing convenience and reduced risk of unexpected costs. Finance leases offer ownership benefits with fixed payments but less flexibility in maintenance and fewer end-of-term choices, usually requiring you to purchase or return the vehicle without additional service inclusions.

Impact on Business Cash Flow

Full service leases for vehicles consolidate costs like maintenance, insurance, and servicing into a fixed monthly payment, providing predictable cash flow and reducing unexpected expenses for businesses. Finance leases require higher upfront payments and ongoing variable costs, potentially straining cash flow due to maintenance and insurance responsibilities falling on the business. Choosing a full service lease offers improved cash flow stability by minimizing financial volatility and allowing better budget forecasting.

Tax Implications and Accounting Treatment

A full service lease typically includes maintenance, insurance, and taxes, which are expensed monthly and can be fully deductible as operating expenses, reducing Your taxable income. In contrast, a finance lease is treated more like a loan for accounting purposes, with the asset capitalized on the balance sheet and the lease payments split into interest and principal, affecting both depreciation and interest expense deductions. The tax implications differ as finance leases allow depreciation benefits, whereas full service leases provide simpler expense recognition without capital asset reporting.

Choosing the Right Lease Type for Your Business

Full service leases include maintenance, insurance, and servicing costs, providing predictable expenses and reducing administrative burdens for your business. Finance leases primarily focus on financing the vehicle, offering potential tax benefits and ownership options at the end of the term but require you to manage upkeep separately. Evaluating your business's cash flow, budgeting preferences, and operational needs will help determine whether a full service or finance lease aligns best with your financial strategy.

full service lease vs finance lease (vehicles) Infographic

libmatt.com

libmatt.com