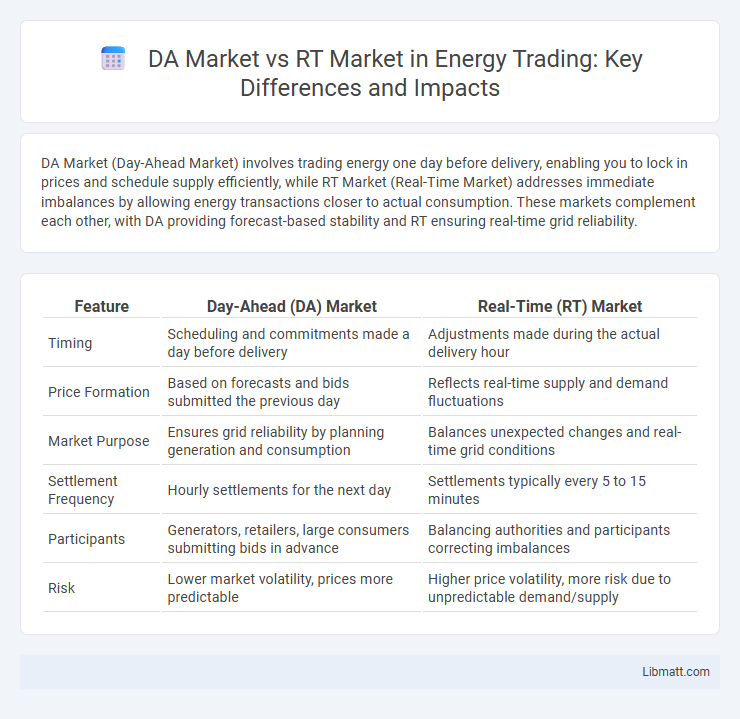

DA Market (Day-Ahead Market) involves trading energy one day before delivery, enabling you to lock in prices and schedule supply efficiently, while RT Market (Real-Time Market) addresses immediate imbalances by allowing energy transactions closer to actual consumption. These markets complement each other, with DA providing forecast-based stability and RT ensuring real-time grid reliability.

Table of Comparison

| Feature | Day-Ahead (DA) Market | Real-Time (RT) Market |

|---|---|---|

| Timing | Scheduling and commitments made a day before delivery | Adjustments made during the actual delivery hour |

| Price Formation | Based on forecasts and bids submitted the previous day | Reflects real-time supply and demand fluctuations |

| Market Purpose | Ensures grid reliability by planning generation and consumption | Balances unexpected changes and real-time grid conditions |

| Settlement Frequency | Hourly settlements for the next day | Settlements typically every 5 to 15 minutes |

| Participants | Generators, retailers, large consumers submitting bids in advance | Balancing authorities and participants correcting imbalances |

| Risk | Lower market volatility, prices more predictable | Higher price volatility, more risk due to unpredictable demand/supply |

Introduction to DA Market and RT Market

The Day-Ahead (DA) Market enables energy traders to secure electricity supply 24 hours prior to the actual delivery, optimizing generation scheduling and demand forecasting. The Real-Time (RT) Market operates closer to the delivery hour, addressing discrepancies between forecasted and actual demand through immediate balancing mechanisms. Together, DA and RT markets enhance grid reliability and price stability by facilitating efficient energy trading under varying temporal requirements.

Key Differences Between DA and RT Markets

Day-Ahead (DA) Market and Real-Time (RT) Market differ primarily in timing and operational flexibility; DA Market involves scheduling energy trades a day before delivery, ensuring planned grid stability and price predictability, while RT Market handles adjustments within the actual operating hour to balance supply and demand dynamically. DA prices are set based on forecasts and bids submitted a day in advance, offering your business a chance to secure energy at known rates, whereas RT prices fluctuate due to real-time grid conditions and unforeseen demand changes. The RT Market serves as a critical corrective mechanism for deviations arising from forecast errors or equipment outages, providing responsive price signals essential for maintaining grid reliability.

Structure and Operation of the DA Market

The Day-Ahead (DA) Market operates as a forward market where electricity prices and quantities are determined one day before the actual delivery, using supply and demand bids to ensure grid reliability and price transparency. Market participants submit their offers and demands for each hour of the next day, enabling system operators to forecast load and schedule generation efficiently. Your participation in the DA Market allows for strategic planning and risk management by locking in prices ahead of real-time fluctuations.

Structure and Operation of the RT Market

The Real-Time (RT) Market operates on a continuous, near-instantaneous basis, enabling the balancing of electricity supply and demand in real-time through five-minute or fifteen-minute intervals, unlike the Day-Ahead (DA) Market which clears trades a day before. It functions through rapid bidding and dispatch processes, facilitating adjustments for unforeseen fluctuations and ensuring grid reliability with real-time pricing signals that reflect immediate system conditions. RT markets rely on automated systems and grid operators' coordination to maintain system stability, manage congestion, and integrate intermittent renewable energy resources effectively.

Price Formation in DA vs RT Energy Trading

Day-Ahead (DA) market price formation in energy trading relies on forecasted supply and demand schedules submitted by market participants, optimized through auction mechanisms to establish clearing prices for each hour of the next day. Real-Time (RT) market price formation reflects immediate system conditions, balancing unexpected fluctuations in load and generation with prices determined by locational marginal pricing (LMP) based on real-time grid constraints and dispatch instructions. DA prices provide a stable benchmark based on anticipated market conditions, while RT prices are more volatile, responding dynamically to actual grid operations and contingencies.

Participant Roles in DA and RT Markets

In energy trading, Day-Ahead (DA) markets primarily involve participants such as generators, suppliers, and load-serving entities who submit bids and offers a day before the operating hour to lock in prices and quantities. Real-Time (RT) markets feature system operators and balancing entities that manage grid reliability by adjusting generation and consumption in response to real-time conditions and unforeseen fluctuations. Your understanding of these distinct participant roles enhances strategic decision-making in both DA and RT energy markets.

Risk Management in DA and RT Markets

Risk management in Day-Ahead (DA) markets centers on forecasting accuracy and contract lock-in, as trades are settled based on predicted loads and generation schedules, reducing intra-day exposure. Real-Time (RT) markets demand agile risk strategies due to rapid price fluctuations and system imbalances, requiring continuous monitoring and quick adjustments to mitigate financial losses. Your ability to balance these risk profiles ensures optimized portfolio performance and minimizes market volatility impact.

Impact on Grid Reliability and Flexibility

Day-Ahead (DA) Market enables grid operators to forecast and schedule energy supply and demand with higher certainty, enhancing grid reliability by minimizing imbalances and reducing the risk of real-time shortages. Real-Time (RT) Market provides critical flexibility by allowing continuous adjustments to energy dispatch based on actual grid conditions, supporting rapid response to fluctuations and unexpected events. Integration of DA and RT markets optimizes overall grid stability by combining precise planning with dynamic operational adaptability.

Challenges and Opportunities in DA vs RT Markets

Day-Ahead (DA) markets face challenges related to forecasting accuracy, requiring precise demand and supply predictions to optimize bidding strategies and minimize imbalance penalties. Real-Time (RT) markets present opportunities through flexibility, enabling rapid adjustments to unexpected grid conditions and renewable generation variability, but pose risks due to price volatility and limited response windows. Effective integration of advanced analytics and grid-scale storage solutions enhances profitability and grid stability across both DA and RT energy trading markets.

Future Trends in DA and RT Energy Trading

Future trends in Day-Ahead (DA) and Real-Time (RT) energy trading emphasize increased integration of renewable energy sources and advanced AI-driven forecasting models to optimize market efficiency. DA markets will likely enhance predictive analytics for improved scheduling and risk management, while RT markets focus on rapid response mechanisms and grid stability through automated demand response technologies. Your ability to leverage real-time data and machine learning algorithms will become crucial in navigating the evolving energy trading landscape.

DA Market vs RT Market (Energy Trading) Infographic

libmatt.com

libmatt.com