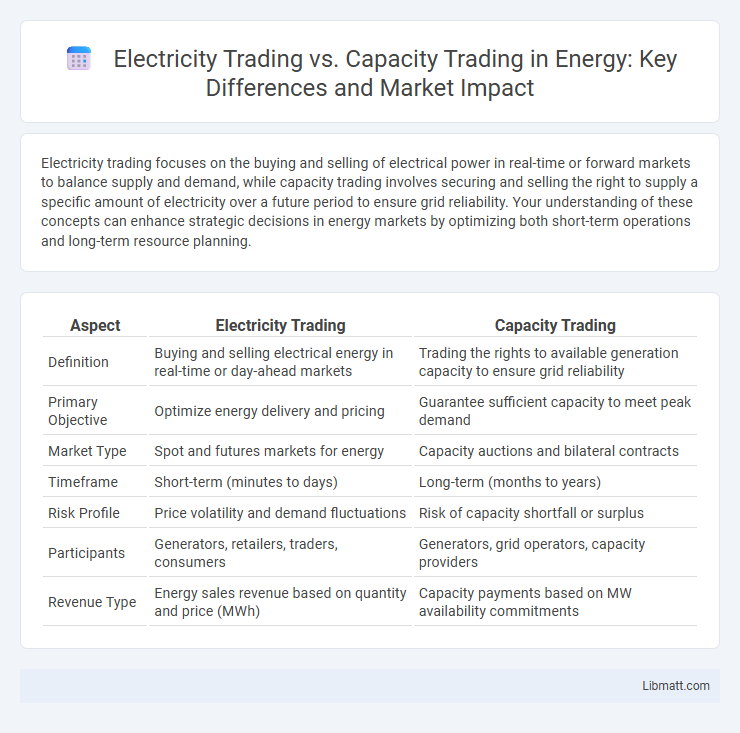

Electricity trading focuses on the buying and selling of electrical power in real-time or forward markets to balance supply and demand, while capacity trading involves securing and selling the right to supply a specific amount of electricity over a future period to ensure grid reliability. Your understanding of these concepts can enhance strategic decisions in energy markets by optimizing both short-term operations and long-term resource planning.

Table of Comparison

| Aspect | Electricity Trading | Capacity Trading |

|---|---|---|

| Definition | Buying and selling electrical energy in real-time or day-ahead markets | Trading the rights to available generation capacity to ensure grid reliability |

| Primary Objective | Optimize energy delivery and pricing | Guarantee sufficient capacity to meet peak demand |

| Market Type | Spot and futures markets for energy | Capacity auctions and bilateral contracts |

| Timeframe | Short-term (minutes to days) | Long-term (months to years) |

| Risk Profile | Price volatility and demand fluctuations | Risk of capacity shortfall or surplus |

| Participants | Generators, retailers, traders, consumers | Generators, grid operators, capacity providers |

| Revenue Type | Energy sales revenue based on quantity and price (MWh) | Capacity payments based on MW availability commitments |

Introduction to Electricity Trading and Capacity Trading

Electricity trading involves buying and selling electrical energy in real-time or day-ahead markets to balance supply and demand efficiently. Capacity trading, on the other hand, revolves around securing commitments from power generators to ensure reliable availability of electricity generation capacity during peak periods. Both markets are crucial for maintaining grid stability and optimizing resource allocation in deregulated electricity markets.

Core Concepts: Electricity Trading Explained

Electricity trading involves buying and selling actual power on spot or forward markets to balance supply and demand in real-time or for future delivery, optimizing costs and grid stability. Capacity trading, on the other hand, deals with securing the availability of generation capacity to ensure reliable power supply during peak demand periods, often through long-term contracts or capacity markets. Your understanding of these core concepts helps navigate market strategies for energy procurement and risk management.

Understanding Capacity Trading in the Energy Market

Capacity trading in the energy market involves buying and selling the rights to available generation capacity rather than actual electricity output, ensuring grid reliability during peak demand periods. This trading mechanism provides revenue certainty for power producers by securing capacity payments, incentivizing investment in maintaining or expanding generation resources. Unlike electricity trading, which deals with real-time or short-term energy delivery, capacity trading focuses on long-term commitments to meet future demand and maintain grid stability.

Key Differences Between Electricity and Capacity Trading

Electricity trading involves the buying and selling of actual electrical energy, typically measured in megawatt-hours (MWh), for immediate or short-term delivery on power markets. Capacity trading focuses on the rights to reserve sufficient generation or demand resources to ensure grid reliability, billed in megawatts (MW) over a capacity commitment period. Key differences include the physical delivery obligation in electricity trading versus the availability commitment in capacity trading, with distinct market products, settlement mechanisms, and regulatory frameworks supporting system adequacy and operational balance.

Market Participants: Who Trades Electricity vs Capacity?

Market participants in electricity trading primarily include utility companies, independent power producers, and retail electricity providers who buy and sell actual electrical energy to balance supply and demand in real-time or in forward contracts. In capacity trading, market participants consist of generation owners, demand response providers, and capacity market operators who trade the rights to deliver electricity capacity in the future, ensuring grid reliability during peak demand periods. While electricity trading centers on the physical flow and price of electric power, capacity trading involves commitments to maintain available generation resources or demand reductions.

Pricing Mechanisms: Spot vs Capacity Payments

Electricity trading primarily relies on spot market pricing, where electricity prices fluctuate based on real-time supply and demand conditions, reflecting immediate market dynamics. Capacity trading involves payments that compensate generators for maintaining available capacity, ensuring grid reliability, typically through predetermined capacity auctions or contracts. Spot prices are highly volatile and influenced by short-term factors, whereas capacity payments provide stable revenue streams to incentivize long-term resource availability.

Risks and Challenges in Electricity and Capacity Trading

Electricity trading involves real-time market fluctuations and demand-supply imbalances, exposing traders to price volatility and grid reliability risks. Capacity trading centers on securing future availability of generation resources, facing challenges like regulatory uncertainty and capacity market design complexities. Both markets require sophisticated risk management strategies to mitigate financial exposure and ensure system stability.

Regulatory Frameworks Governing Both Markets

Regulatory frameworks for electricity trading focus on real-time market operations, price transparency, and grid reliability to ensure efficient energy distribution. Capacity trading regulations emphasize long-term resource adequacy, mandating providers to guarantee available generation capacity during peak demand periods. Your participation in these markets requires understanding distinct compliance standards set by entities such as FERC in the US or ACER in Europe.

Future Trends in Electricity and Capacity Trading

Future trends in electricity trading highlight increased use of AI and blockchain technology to enhance market transparency and efficiency. Capacity trading is evolving with growing emphasis on grid reliability and incentivizing energy storage and demand response solutions. You can expect these advancements to drive a more flexible and resilient energy market, balancing supply stability with variable renewable integration.

Conclusion: Choosing the Right Trading Model

Selecting the appropriate trading model depends on market objectives and risk tolerance within energy sectors. Electricity trading optimizes short-term supply-demand balancing through spot and forward markets, while capacity trading ensures long-term reliability by securing generation resources. Evaluating operational flexibility and financial goals drives effective integration of both strategies for sustainable energy management.

Electricity Trading vs Capacity Trading Infographic

libmatt.com

libmatt.com