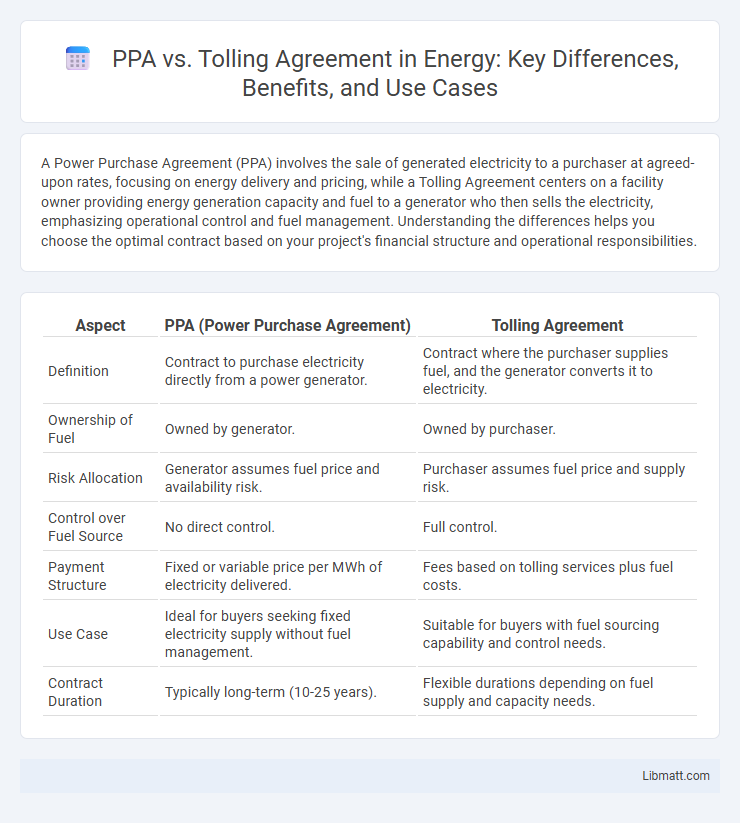

A Power Purchase Agreement (PPA) involves the sale of generated electricity to a purchaser at agreed-upon rates, focusing on energy delivery and pricing, while a Tolling Agreement centers on a facility owner providing energy generation capacity and fuel to a generator who then sells the electricity, emphasizing operational control and fuel management. Understanding the differences helps you choose the optimal contract based on your project's financial structure and operational responsibilities.

Table of Comparison

| Aspect | PPA (Power Purchase Agreement) | Tolling Agreement |

|---|---|---|

| Definition | Contract to purchase electricity directly from a power generator. | Contract where the purchaser supplies fuel, and the generator converts it to electricity. |

| Ownership of Fuel | Owned by generator. | Owned by purchaser. |

| Risk Allocation | Generator assumes fuel price and availability risk. | Purchaser assumes fuel price and supply risk. |

| Control over Fuel Source | No direct control. | Full control. |

| Payment Structure | Fixed or variable price per MWh of electricity delivered. | Fees based on tolling services plus fuel costs. |

| Use Case | Ideal for buyers seeking fixed electricity supply without fuel management. | Suitable for buyers with fuel sourcing capability and control needs. |

| Contract Duration | Typically long-term (10-25 years). | Flexible durations depending on fuel supply and capacity needs. |

Introduction to PPA and Tolling Agreements

Power Purchase Agreements (PPAs) are long-term contracts where a power producer sells electricity directly to a purchaser, often a utility or large customer, ensuring stable pricing and supply. Tolling Agreements involve a third party providing fuel or energy inputs to a power plant operator, who then converts the fuel into electricity and sells the output back to the owner or another party. Both agreements structure the financial and operational responsibilities differently, optimizing risk and asset management in energy projects.

Definition of Power Purchase Agreement (PPA)

A Power Purchase Agreement (PPA) is a contractual arrangement where a power producer sells electricity directly to a buyer, typically a utility or large energy consumer, at agreed prices and terms. This long-term contract outlines the delivery, pricing, and payment structure for the generated power, securing revenue for the producer and supply stability for the purchaser. Your understanding of a PPA helps differentiate it from tolling agreements, which involve different operational and financial responsibilities in power generation.

Definition of Tolling Agreement

A Tolling Agreement is a contract where one party supplies raw materials or intermediate products to another party for processing, with the finished goods returned to the original supplier or sold on their behalf. Unlike a Power Purchase Agreement (PPA), which involves the sale of electricity over a fixed term, a Tolling Agreement emphasizes the processing or conversion of inputs into outputs without transferring ownership of the final product. Your choice between these agreements should depend on whether you need energy procurement or processing services in your project.

Key Differences Between PPA and Tolling Agreement

Power Purchase Agreements (PPA) involve the sale of electricity from a generator directly to a buyer, securing fixed prices and long-term energy delivery. Tolling Agreements, in contrast, allow the power plant owner to utilize fuel provided by the buyer to generate electricity, where the buyer pays for the fuel and receives the power output. Your choice depends on whether you prefer to control fuel supply and manage energy risks or seek predictable pricing with a PPA.

Contractual Structure Comparison

Power Purchase Agreements (PPAs) establish a direct contractual relationship between the electricity generator and the off-taker, defining terms for energy delivery, pricing, and duration, while Tolling Agreements involve a third party owning the fuel and controlling the dispatch, with the plant operator managing power generation for a fixed fee. PPAs transfer volume and price risks to the off-taker, whereas Tolling Agreements allocate fuel cost risks to the third party, isolating the power plant owner from fuel market volatility. The contractual structure of PPAs centers on energy sales, whereas Tolling Agreements focus on operational services, reflecting distinct risk and control allocations.

Risk Allocation in PPA vs Tolling Agreement

Risk allocation in a Power Purchase Agreement (PPA) primarily places demand and market risks on the buyer, who commits to purchasing a fixed or minimum quantity of power, ensuring steady revenue for the seller. In contrast, a Tolling Agreement shifts fuel price and supply risks to the off-taker while the owner retains operational and volume risks, as the off-taker supplies fuel and pays for plant availability rather than electricity output. Understanding these differences helps you identify which contract better aligns with your risk tolerance and operational control preferences.

Financial Implications and Revenue Models

PPA (Power Purchase Agreement) involves a fixed or indexed price for electricity over a long-term contract, providing predictable revenue and reducing market exposure risks for your energy project. Tolling Agreements, by contrast, convert fuel into electricity with the buyer often covering fuel costs separately, shifting some financial risks and offering flexibility in pricing based on market conditions. Understanding these revenue models is crucial as PPAs secure steady cash flow while Tolling Agreements may yield variable profits depending on operational efficiency and fuel price volatility.

Suitability for Different Energy Projects

PPA agreements are ideal for renewable energy projects where long-term power off-take and price certainty are critical, such as solar and wind farms. Tolling agreements suit projects with existing generation assets or where developers seek flexibility in fuel sourcing and price risk management, common in gas-fired power plants. Your choice depends on project scale, resource predictability, and financial strategy alignment.

Legal and Regulatory Considerations

PPA (Power Purchase Agreement) and Tolling Agreements differ significantly in their legal and regulatory frameworks, with PPAs primarily governed by energy market regulations and utility commission approvals, while Tolling Agreements are often treated as contractual arrangements subject to commercial and financial regulations. Regulatory considerations for PPAs include compliance with renewable energy mandates, tariff approvals, and grid interconnection standards, whereas Tolling Agreements require adherence to fuel supply laws, operational control clauses, and liability allocation. Your choice between these agreements will impact risk allocation, with PPAs typically offering more regulatory oversight and Tolling Agreements providing greater operational flexibility under contract law.

Choosing Between PPA and Tolling Agreement

Choosing between a Power Purchase Agreement (PPA) and a Tolling Agreement depends on the project's ownership structure and risk tolerance. PPAs typically transfer the electricity production risk to the off-taker by locking in energy prices, while Tolling Agreements enable plant owners to sell fuel and purchase back electricity, maintaining control over market exposure. Careful evaluation of financial, operational, and market factors is essential to determine the optimal contract structure for renewable energy projects.

PPA vs Tolling Agreement Infographic

libmatt.com

libmatt.com