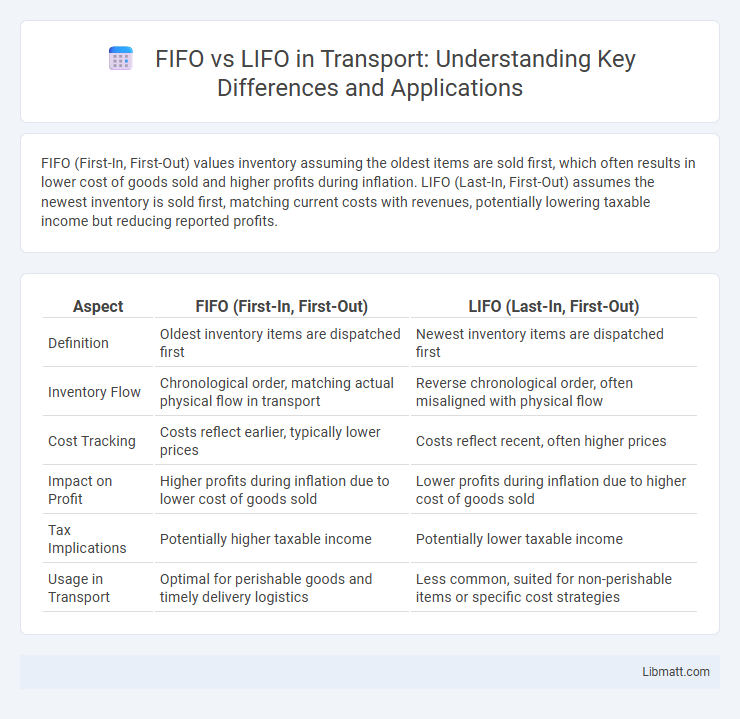

FIFO (First-In, First-Out) values inventory assuming the oldest items are sold first, which often results in lower cost of goods sold and higher profits during inflation. LIFO (Last-In, First-Out) assumes the newest inventory is sold first, matching current costs with revenues, potentially lowering taxable income but reducing reported profits.

Table of Comparison

| Aspect | FIFO (First-In, First-Out) | LIFO (Last-In, First-Out) |

|---|---|---|

| Definition | Oldest inventory items are dispatched first | Newest inventory items are dispatched first |

| Inventory Flow | Chronological order, matching actual physical flow in transport | Reverse chronological order, often misaligned with physical flow |

| Cost Tracking | Costs reflect earlier, typically lower prices | Costs reflect recent, often higher prices |

| Impact on Profit | Higher profits during inflation due to lower cost of goods sold | Lower profits during inflation due to higher cost of goods sold |

| Tax Implications | Potentially higher taxable income | Potentially lower taxable income |

| Usage in Transport | Optimal for perishable goods and timely delivery logistics | Less common, suited for non-perishable items or specific cost strategies |

Introduction to Inventory Valuation Methods

Inventory valuation methods like FIFO (First-In, First-Out) and LIFO (Last-In, First-Out) determine the cost flow of inventory and directly impact financial statements and tax liabilities. FIFO assumes the oldest inventory items are sold first, often resulting in lower cost of goods sold and higher profits during inflation, while LIFO assumes the newest inventory is sold first, potentially reducing taxable income by matching current costs with current revenues. Understanding these methods helps you make informed decisions on inventory management, profitability analysis, and regulatory compliance.

What is FIFO?

FIFO (First-In, First-Out) is an inventory valuation method where the oldest inventory items are recorded as sold first, ensuring that the cost of goods sold reflects the earliest purchased or produced items. This approach matches current sales with earlier costs, which often results in higher reported profits during periods of rising prices. Using FIFO, Your financial statements more accurately represent current market conditions by valuing remaining inventory at more recent costs.

What is LIFO?

LIFO (Last In, First Out) is an inventory valuation method where the most recently acquired items are sold or used first, impacting cost of goods sold and ending inventory values. This approach often results in higher cost of goods sold and lower taxable income during periods of rising prices, compared to FIFO (First In, First Out). LIFO is commonly used for tax advantages and better matching of current costs with revenues in financial statements.

Key Differences Between FIFO and LIFO

FIFO (First-In, First-Out) assumes that the oldest inventory items are sold first, resulting in lower cost of goods sold (COGS) and higher ending inventory during inflation. LIFO (Last-In, First-Out) assumes the newest inventory is sold first, leading to higher COGS and lower taxable income in periods of rising prices. Inventory valuation, tax impact, and financial reporting are the primary factors differentiating FIFO and LIFO methods.

Impact on Financial Statements

FIFO (First-In, First-Out) typically results in higher ending inventory values and lower cost of goods sold during periods of rising prices, leading to increased net income and higher taxable income on financial statements. LIFO (Last-In, First-Out) matches recent higher costs with current revenues, reducing taxable income and decreasing net income but lowering ending inventory values on the balance sheet. The choice between FIFO and LIFO significantly affects gross profit, tax liabilities, and inventory valuation, influencing financial ratios and investor decisions.

Tax Implications of FIFO and LIFO

FIFO (First-In, First-Out) generally results in higher taxable income during periods of rising prices because older, lower-cost inventory is recorded as cost of goods sold, leading to higher reported profits. LIFO (Last-In, First-Out) typically lowers taxable income by matching recent higher costs against current revenues, which can reduce tax liability and improve cash flow in inflationary environments. Companies must consider that LIFO is not permitted under IFRS, limiting its international tax reporting benefits compared to FIFO.

Industry Preferences and Usage

Manufacturing and retail industries predominantly favor FIFO (First-In, First-Out) due to its alignment with the natural flow of perishable goods and accurate inventory valuation during inflation. LIFO (Last-In, First-Out) is more commonly used in industries like oil and gas or steel manufacturing, where inventory costs tend to rise, offering tax advantages by matching recent higher costs against current revenues. Your choice between FIFO and LIFO significantly impacts financial reporting, tax obligations, and inventory management strategies in industry-specific contexts.

Pros and Cons of FIFO

FIFO (First In, First Out) ensures inventory valuation closely matches actual stock flow, resulting in accurate balance sheets and reduced risk of inventory obsolescence. This method can lead to higher taxable income during inflationary periods because older, lower-cost items are expensed first. However, FIFO improves cash flow management by reflecting current market prices in ending inventory, though it may increase tax liabilities compared to LIFO.

Pros and Cons of LIFO

LIFO (Last-In, First-Out) accounting offers tax advantages by matching recent higher costs against current revenues, reducing taxable income during inflationary periods. However, LIFO can distort inventory valuation on the balance sheet, as older inventory costs remain while recent costs are expensed, potentially understating asset value. Your financial statements may show lower profits and inventory values compared to FIFO, impacting investor perceptions and loan covenants.

Choosing the Right Method for Your Business

Choosing the right inventory valuation method depends on your business goals, tax strategy, and market conditions. FIFO (First-In, First-Out) reflects current market prices more accurately during inflation, potentially increasing net income and improving asset valuation on your balance sheet. LIFO (Last-In, First-Out) can reduce taxable income by matching recent higher costs against current revenues, benefiting businesses aiming to minimize tax liabilities during rising prices.

FIFO vs LIFO Infographic

libmatt.com

libmatt.com