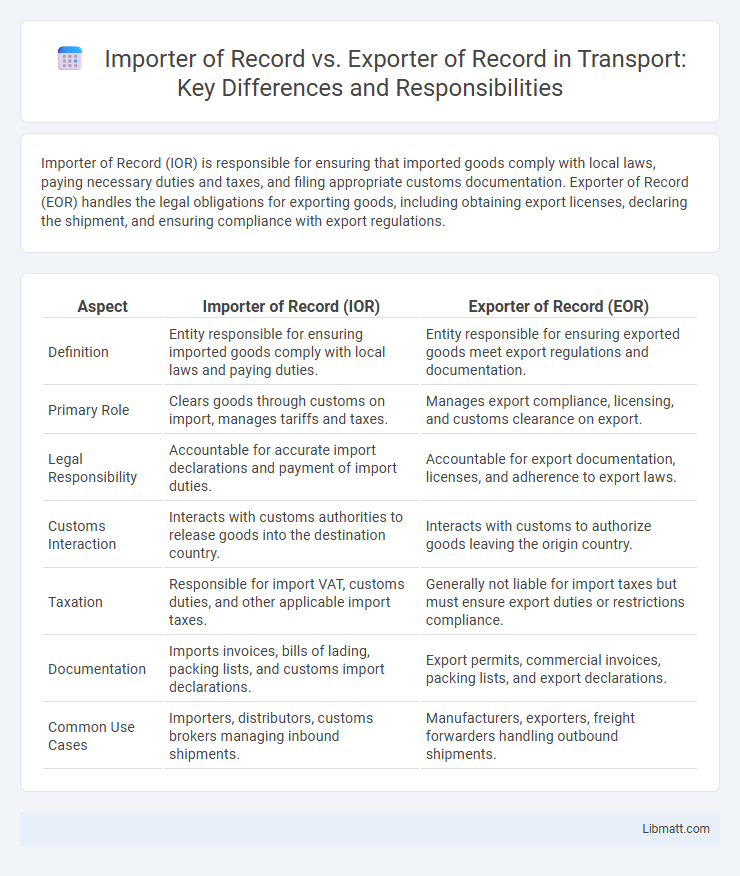

Importer of Record (IOR) is responsible for ensuring that imported goods comply with local laws, paying necessary duties and taxes, and filing appropriate customs documentation. Exporter of Record (EOR) handles the legal obligations for exporting goods, including obtaining export licenses, declaring the shipment, and ensuring compliance with export regulations.

Table of Comparison

| Aspect | Importer of Record (IOR) | Exporter of Record (EOR) |

|---|---|---|

| Definition | Entity responsible for ensuring imported goods comply with local laws and paying duties. | Entity responsible for ensuring exported goods meet export regulations and documentation. |

| Primary Role | Clears goods through customs on import, manages tariffs and taxes. | Manages export compliance, licensing, and customs clearance on export. |

| Legal Responsibility | Accountable for accurate import declarations and payment of import duties. | Accountable for export documentation, licenses, and adherence to export laws. |

| Customs Interaction | Interacts with customs authorities to release goods into the destination country. | Interacts with customs to authorize goods leaving the origin country. |

| Taxation | Responsible for import VAT, customs duties, and other applicable import taxes. | Generally not liable for import taxes but must ensure export duties or restrictions compliance. |

| Documentation | Imports invoices, bills of lading, packing lists, and customs import declarations. | Export permits, commercial invoices, packing lists, and export declarations. |

| Common Use Cases | Importers, distributors, customs brokers managing inbound shipments. | Manufacturers, exporters, freight forwarders handling outbound shipments. |

Introduction to Importer of Record (IOR) and Exporter of Record (EOR)

The Importer of Record (IOR) is the entity responsible for ensuring compliance with all customs regulations, duties, and taxes upon the arrival of goods into a country. The Exporter of Record (EOR) manages the legal and regulatory requirements when goods leave the origin country, including export documentation and licenses. Both roles are critical in international trade to guarantee proper shipment handling, regulatory adherence, and smooth cross-border transactions.

Key Definitions: IOR vs EOR

Importer of Record (IOR) is the entity responsible for ensuring goods comply with local import regulations, paying duties, and managing customs clearance upon entering a country. Exporter of Record (EOR) handles compliance, documentation, and shipment authorization when goods leave the country of origin. Understanding the distinct roles of IOR and EOR helps you maintain regulatory compliance and avoid logistical delays in international trade.

Roles and Responsibilities of Importer of Record

The Importer of Record (IOR) is responsible for ensuring compliance with all customs regulations, accurate classification, valuation of goods, and payment of duties and taxes upon entry into the destination country. The IOR must prepare and submit all required documentation, including customs declarations, invoices, and licenses, maintaining adherence to import laws to avoid delays or penalties. This role also involves managing logistics coordination and risk management to ensure smooth customs clearance and timely delivery of imported goods.

Roles and Responsibilities of Exporter of Record

The Exporter of Record (EOR) is responsible for ensuring all export compliance regulations are met, including obtaining necessary licenses, preparing accurate export documentation, and declaring the shipment's contents and value to customs authorities. This role involves coordinating with carriers, verifying the classification of goods under the Harmonized Tariff Schedule, and ensuring adherence to trade sanctions and embargoes. Your compliance as the EOR safeguards smooth customs clearance and mitigates the risk of penalties or shipment delays.

Legal Requirements for IOR and EOR

The Importer of Record (IOR) must comply with all customs regulations, ensure accurate documentation, and is legally responsible for import duties, taxes, and adherence to local import laws in the destination country. The Exporter of Record (EOR) is accountable for customs compliance at the origin, including export licenses, accurate export declarations, and ensuring that goods meet export control regulations. Failure to meet legal requirements for either IOR or EOR can result in penalties, shipment delays, and legal liabilities under international trade laws.

Documentation Differences: IOR vs EOR

Importer of Record (IOR) and Exporter of Record (EOR) have distinct documentation requirements critical for customs compliance. IOR is responsible for import documentation such as customs entry forms, bills of lading, commercial invoices, and duties payment records, ensuring accurate declaration of goods entering a country. Conversely, EOR manages export documentation including export licenses, export declarations, commercial invoices, and shipping manifests to comply with export regulations and facilitate legal shipment from the country.

Compliance and Regulatory Considerations

Importer of Record (IOR) is responsible for ensuring compliance with local customs regulations, including accurate declaration, payment of duties, taxes, and adherence to import licenses and product standards. Exporter of Record (EOR) must comply with export control laws, secure proper documentation, and verify destination country restrictions to avoid penalties and shipment delays. Your choice between IOR and EOR affects liability for regulatory compliance, impacting the smooth flow of goods across borders and reducing legal risks.

Common Challenges in IOR and EOR Processes

Common challenges in Importer of Record (IOR) and Exporter of Record (EOR) processes include compliance with diverse international regulations, managing accurate documentation, and ensuring timely customs clearance to avoid delays. You must navigate complex tariff classifications and maintain strict adherence to local legal requirements to prevent penalties or shipment holds. Efficient coordination between IOR and EOR roles is crucial to streamline logistics and mitigate risks in global trade operations.

Choosing the Right Service Provider: IOR vs EOR

Selecting the right service provider between Importer of Record (IOR) and Exporter of Record (EOR) hinges on your specific trade requirements and compliance obligations. The IOR assumes responsibility for customs clearance and import duties in the destination country, ensuring your shipments meet local regulations, while the EOR handles export documentation and compliance from the country of origin. Understanding your supply chain's needs and the regulatory environment helps you optimize logistics, reduce liability, and maintain smooth international trade operations.

Conclusion: IOR vs EOR in Global Trade

Importer of Record (IOR) assumes responsibility for ensuring compliance with import regulations, including payment of duties and taxes, while Exporter of Record (EOR) manages export documentation and adherence to export control laws. In global trade, selecting the appropriate entity depends on the transaction's direction and regulatory environment, with IOR critical for lawful import clearance and EOR essential for legal export processing. Effective global supply chain management relies on clear designation of IOR and EOR roles to mitigate risks, optimize customs compliance, and streamline cross-border shipments.

Importer of Record vs Exporter of Record Infographic

libmatt.com

libmatt.com