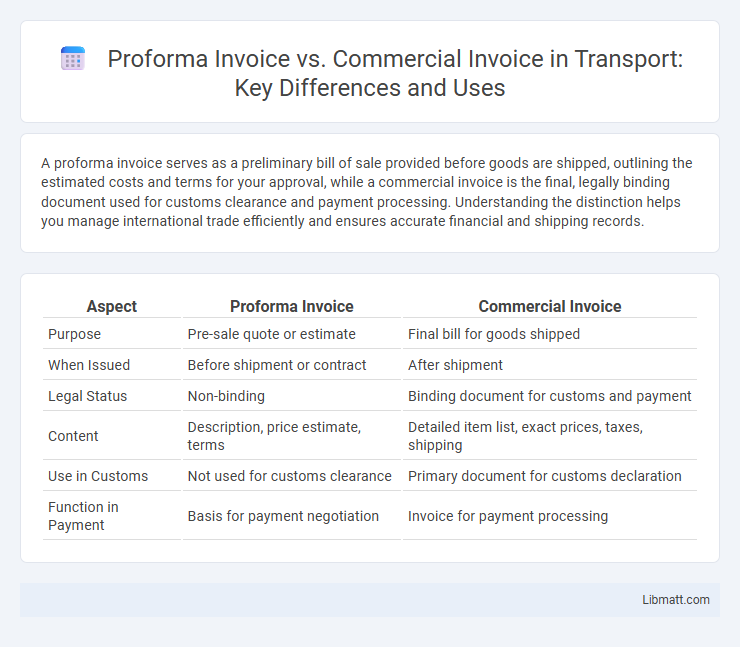

A proforma invoice serves as a preliminary bill of sale provided before goods are shipped, outlining the estimated costs and terms for your approval, while a commercial invoice is the final, legally binding document used for customs clearance and payment processing. Understanding the distinction helps you manage international trade efficiently and ensures accurate financial and shipping records.

Table of Comparison

| Aspect | Proforma Invoice | Commercial Invoice |

|---|---|---|

| Purpose | Pre-sale quote or estimate | Final bill for goods shipped |

| When Issued | Before shipment or contract | After shipment |

| Legal Status | Non-binding | Binding document for customs and payment |

| Content | Description, price estimate, terms | Detailed item list, exact prices, taxes, shipping |

| Use in Customs | Not used for customs clearance | Primary document for customs declaration |

| Function in Payment | Basis for payment negotiation | Invoice for payment processing |

Understanding Proforma Invoices

A proforma invoice is a preliminary document issued by a seller to a buyer detailing the goods or services to be provided, including estimated prices and terms, but it is not a demand for payment. It serves as a quotation to facilitate customs clearance, import licenses, or buyer approval before the final sale. Unlike a commercial invoice, which is an official document used for payment and customs declaration after shipment, the proforma invoice is primarily a commitment to sell under specified conditions.

What is a Commercial Invoice?

A commercial invoice is a critical financial document used in international trade that details the sale transaction between the exporter and importer, including product descriptions, quantities, prices, and payment terms. It serves as a customs declaration for the shipment, facilitating customs clearance and duty assessment. Unlike a proforma invoice, which is a preliminary quote, the commercial invoice is legally binding and accompanies the shipped goods.

Key Differences Between Proforma and Commercial Invoices

A proforma invoice serves as an initial quote outlining the estimated costs and details of goods or services before a transaction is finalized, while a commercial invoice is the official document generated after the sale, detailing the exact quantities, prices, and terms for payment and shipment. Proforma invoices do not demand payment and are often used for customs or internal approval purposes, whereas commercial invoices act as a legally binding request for payment and are essential for import and export clearance. Understanding these key differences helps ensure your international trade processes comply with both financial and customs regulations efficiently.

Purpose of a Proforma Invoice

A proforma invoice serves as a preliminary bill of sale sent to buyers before the shipment of goods, outlining the estimated costs, quantities, and specifications to confirm the terms of a potential sale. Its primary purpose is to provide clarity and transparency for customs declarations, budget approvals, or payment arrangements without being a final demand for payment. You rely on a proforma invoice to establish expectations and facilitate smooth international trade transactions before issuing the commercial invoice, which acts as the official financial document.

Usage of Commercial Invoices in International Trade

Commercial invoices serve as critical legal documents in international trade, detailing the transaction between exporter and importer, including product descriptions, quantities, prices, and payment terms. They facilitate customs clearance by providing accurate information for duties and taxes assessment, ensuring compliance with import regulations. Unlike proforma invoices, commercial invoices confirm the sale and are required for customs processing, payment, and shipment release.

Required Information on Proforma vs Commercial Invoices

A proforma invoice typically includes estimated details such as product description, quantity, price, weight, and shipping costs, serving as a preliminary bill before final sale confirmation. A commercial invoice contains accurate and complete information required by customs, including seller and buyer details, payment terms, HS codes, and declared value for duties. Your accurate distinction between these invoices ensures smooth customs clearance and transaction processing.

Legal Implications: Proforma vs Commercial Invoice

A proforma invoice serves as a preliminary document outlining the estimated costs and terms of a transaction but is not legally binding, whereas a commercial invoice functions as a definitive legal document required for customs clearance and payment processing. The commercial invoice includes detailed information such as the exact description, quantity, and value of goods, making it crucial for legal ownership transfer and tax assessments. Your business must rely on the commercial invoice for enforcing contractual obligations and fulfilling regulatory compliance, while the proforma invoice primarily aids in negotiation and planning stages.

When to Use a Proforma Invoice

A proforma invoice is used before a sale is finalized to provide a detailed estimate or quotation, outlining prices, quantities, and terms without acting as a binding document. It helps You confirm the costs and terms with a buyer, facilitating customs clearance or internal approvals prior to shipping goods. Unlike a commercial invoice, which serves as the official bill after the sale, the proforma invoice is essential during the negotiation and order confirmation stages.

When to Issue a Commercial Invoice

A commercial invoice should be issued after goods have been shipped and the sale transaction is finalized, serving as a legal document for customs clearance, payment, and import duties. It contains detailed information about the buyer, seller, product description, quantity, price, and terms of sale, ensuring compliance with international trade regulations. You must provide a commercial invoice to customs authorities and the buyer to facilitate smooth delivery and payment processing.

Choosing the Right Invoice for Your Business Needs

Selecting the right invoice between a proforma invoice and a commercial invoice depends on the stage of your transaction and business requirements. A proforma invoice is a preliminary document providing an estimated cost for approval before shipment, ideal for quotes and securing buyer commitment. A commercial invoice, however, is the final bill used for customs clearance and payment processing, making it essential for completing international sales and ensuring compliance.

proforma invoice vs commercial invoice Infographic

libmatt.com

libmatt.com