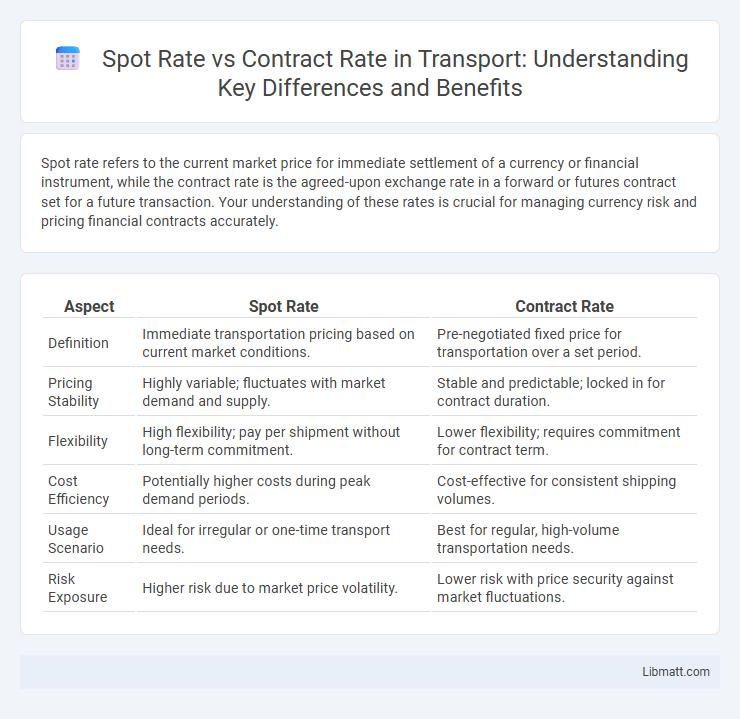

Spot rate refers to the current market price for immediate settlement of a currency or financial instrument, while the contract rate is the agreed-upon exchange rate in a forward or futures contract set for a future transaction. Your understanding of these rates is crucial for managing currency risk and pricing financial contracts accurately.

Table of Comparison

| Aspect | Spot Rate | Contract Rate |

|---|---|---|

| Definition | Immediate transportation pricing based on current market conditions. | Pre-negotiated fixed price for transportation over a set period. |

| Pricing Stability | Highly variable; fluctuates with market demand and supply. | Stable and predictable; locked in for contract duration. |

| Flexibility | High flexibility; pay per shipment without long-term commitment. | Lower flexibility; requires commitment for contract term. |

| Cost Efficiency | Potentially higher costs during peak demand periods. | Cost-effective for consistent shipping volumes. |

| Usage Scenario | Ideal for irregular or one-time transport needs. | Best for regular, high-volume transportation needs. |

| Risk Exposure | Higher risk due to market price volatility. | Lower risk with price security against market fluctuations. |

Understanding Spot Rate: Definition and Basics

Spot rate refers to the current market price at which a currency, commodity, or financial instrument can be bought or sold for immediate delivery. It represents the real-time exchange rate that reflects supply and demand factors in the foreign exchange market. Understanding the spot rate is crucial for traders and businesses to assess the fair value of transactions settled instantly without delay.

What Is a Contract Rate? Key Differences Explained

A contract rate is the fixed interest rate agreed upon in a loan or mortgage agreement that remains constant throughout the loan term, providing predictable payment amounts. Unlike the spot rate, which reflects the current market interest rate and can fluctuate daily, the contract rate locks in the borrowing cost at the time of contract signing. Understanding the differences between these rates helps you evaluate potential financing options and manage future payment expectations effectively.

Calculation Methods for Spot and Contract Rates

Spot rates are calculated based on current market prices for immediate settlement, reflecting real-time supply and demand conditions. Contract rates, on the other hand, are pre-agreed fixed rates specified in forward contracts or agreements, determined at the time of the contract and unaffected by subsequent market fluctuations. Understanding the difference helps you assess pricing accuracy and financial exposure in currency exchange or interest rate hedging.

Factors Influencing Spot Rate Fluctuations

Spot rate fluctuations are influenced by factors such as supply and demand in the foreign exchange market, interest rate differentials between countries, and geopolitical events affecting currency stability. Economic indicators like inflation, employment data, and central bank policies also play a significant role in causing spot rates to vary frequently. Understanding these dynamics helps you anticipate changes compared to the fixed nature of contract rates.

How Contract Rates Are Determined in Business

Contract rates in business are determined by negotiating terms between the parties involved, factoring in market conditions, creditworthiness, and the duration of the contract. These rates often reflect agreed-upon fixed prices that provide stability against the fluctuating spot rates seen in real-time market transactions. Businesses analyze historical data, risk assessments, and expected future market trends to establish contract rates that mitigate exposure to spot rate volatility.

Pros and Cons of Using Spot Rates

Spot rates offer real-time pricing reflecting current market demand and supply, enabling you to make immediate and potentially cost-effective foreign exchange transactions. However, their volatility can introduce risk, leading to unpredictable costs and possible financial exposure. Choosing spot rates requires careful consideration of your risk tolerance and market conditions to balance potential savings against price fluctuations.

Advantages and Disadvantages of Contract Rates

Contract rates provide certainty by locking in exchange rates for future transactions, protecting Your business from adverse currency fluctuations. However, these rates may be less favorable than spot rates if the market moves in your favor, potentially resulting in missed savings opportunities. The main disadvantage is reduced flexibility compared to spot rates, which reflect real-time market conditions and can capitalize on immediate favorable changes.

Spot Rate vs Contract Rate: Which Is Better for Your Needs?

Spot rate reflects the current market price for immediate currency exchange, offering real-time rates without future commitment, ideal for urgent transactions. Contract rate, or forward rate, locks in a currency exchange rate for a future date, providing protection against market volatility and budget certainty. Your choice depends on whether you prioritize immediate pricing accuracy with spot rates or financial predictability through contract rates.

Impact of Market Volatility on Spot and Contract Rates

Market volatility causes significant fluctuations in spot rates as they reflect real-time currency values influenced by supply and demand dynamics. Contract rates, fixed through forward contracts, provide stability by locking exchange rates ahead of time, insulating businesses from sudden market swings. Enterprises utilizing forward contracts benefit from predictable costs and reduced exchange rate risk amid volatile forex markets.

Practical Applications: Choosing Between Spot and Contract Rates

Businesses engaged in international trade often choose between spot rates and contract rates based on currency risk management and budget forecasting. Spot rates are used for immediate currency exchanges, providing real-time pricing beneficial for urgent transactions, while contract rates, set through forward contracts, secure a fixed exchange rate for future transactions, protecting against currency volatility. Companies with predictable cash flows prefer contract rates to stabilize costs, whereas those requiring flexibility may rely on spot rates to capitalize on favorable market conditions.

spot rate vs contract rate Infographic

libmatt.com

libmatt.com