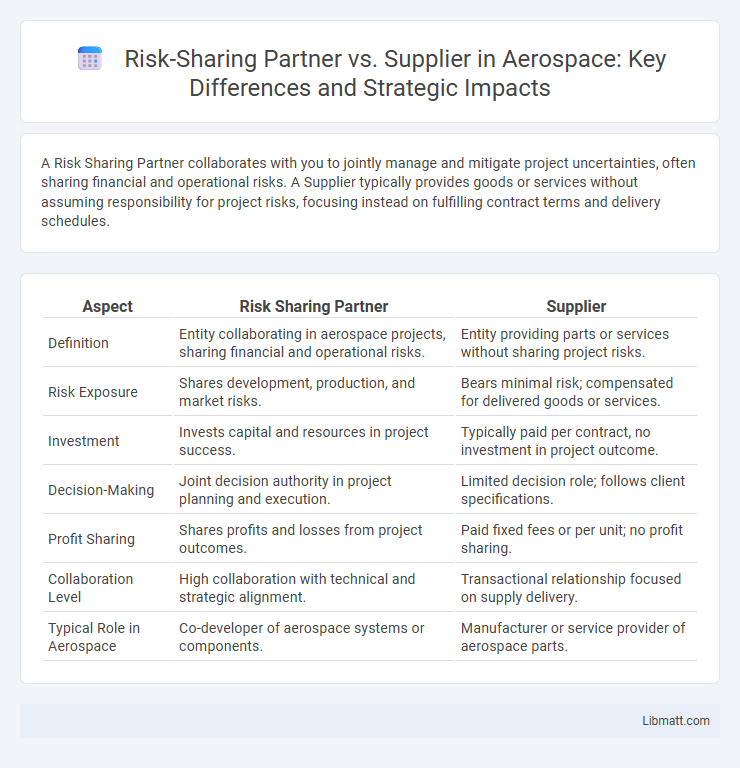

A Risk Sharing Partner collaborates with you to jointly manage and mitigate project uncertainties, often sharing financial and operational risks. A Supplier typically provides goods or services without assuming responsibility for project risks, focusing instead on fulfilling contract terms and delivery schedules.

Table of Comparison

| Aspect | Risk Sharing Partner | Supplier |

|---|---|---|

| Definition | Entity collaborating in aerospace projects, sharing financial and operational risks. | Entity providing parts or services without sharing project risks. |

| Risk Exposure | Shares development, production, and market risks. | Bears minimal risk; compensated for delivered goods or services. |

| Investment | Invests capital and resources in project success. | Typically paid per contract, no investment in project outcome. |

| Decision-Making | Joint decision authority in project planning and execution. | Limited decision role; follows client specifications. |

| Profit Sharing | Shares profits and losses from project outcomes. | Paid fixed fees or per unit; no profit sharing. |

| Collaboration Level | High collaboration with technical and strategic alignment. | Transactional relationship focused on supply delivery. |

| Typical Role in Aerospace | Co-developer of aerospace systems or components. | Manufacturer or service provider of aerospace parts. |

Understanding Risk Sharing in Business Relationships

Risk sharing in business relationships involves distributing potential losses and rewards between partners to align interests and mitigate financial exposure. A risk sharing partner actively participates in decision-making and bears a portion of operational risks, fostering collaboration and joint accountability. Suppliers typically assume limited risk focused on delivery and quality, while partners share broader strategic and financial risks to achieve mutual growth.

Defining Risk Sharing Partners

Risk sharing partners are entities that collaboratively undertake financial, operational, or legal risks to achieve mutual business goals, contrasting with traditional suppliers who typically bear limited risk confined to delivery and quality of goods or services. These partners actively participate in decision-making processes, sharing both potential gains and losses, which fosters deeper integration and alignment between organizations. Defining risk sharing partners involves identifying collaborators who contribute investments, share uncertainties, and commit to joint accountability beyond standard supplier roles.

Defining Supplier Relationships

Risk sharing partner relationships involve collaborative agreements where both parties share potential risks and rewards, promoting joint accountability and innovation. Supplier relationships typically focus on transactional exchanges where the supplier provides goods or services without direct risk involvement in the buyer's outcomes. Understanding these distinctions helps you tailor contract terms and communication strategies to optimize supply chain resilience and performance.

Key Differences Between Risk Sharing Partners and Suppliers

Risk sharing partners actively collaborate to distribute financial and operational risks, aligning their goals closely with the project's success, while suppliers primarily provide goods or services based on contracts without sharing business risks. Risk sharing involves joint accountability for outcomes, incentive-based performance, and long-term strategic relationships. Suppliers typically maintain transactional roles focused on delivery and compliance, with limited exposure to project uncertainties or profit fluctuations.

Strategic Value: Partner vs. Supplier

A Risk Sharing Partner offers strategic value by collaboratively managing uncertainties and aligning goals, leading to shared rewards and long-term innovation. Suppliers typically focus on transactional relationships with fixed deliverables, limiting strategic flexibility and joint problem-solving opportunities. Your business gains greater resilience and competitive advantage by engaging Risk Sharing Partners who contribute to mutual growth and risk mitigation.

Risk Allocation and Responsibility

Risk sharing partners distribute project risks by jointly assuming financial, operational, and strategic responsibilities, ensuring mutual accountability in outcomes. Suppliers typically bear risks limited to delivery performance, quality compliance, and contractual obligations, with less involvement in broader project uncertainties. Effective risk allocation between partners enhances collaboration and innovation, while suppliers focus on minimizing transactional risks to maintain service reliability.

Long-term Collaboration and Innovation

Risk Sharing Partners foster long-term collaboration by aligning goals and sharing financial risks, which drives joint innovation and continuous improvement. Suppliers typically maintain transactional relationships with fixed terms, limiting opportunities for co-development and strategic growth. Your business benefits from partnering with risk sharing entities that prioritize shared success and breakthrough innovations over isolated delivery.

Financial Implications for Businesses

Risk sharing partners distribute financial liabilities arising from project uncertainties, mitigating the burden on your business by aligning costs with outcomes and reducing capital exposure. Suppliers typically assume limited financial risk, often transferring cost overruns or delays back to the buyer, which may increase your overall expenditure unpredictably. Opting for a risk sharing partner can enhance financial stability by linking payments to performance, safeguarding cash flow, and fostering joint investment in project success.

Choosing the Right Relationship Model

Choosing the right relationship model between a risk sharing partner and a supplier depends on your organization's project complexity, financial exposure, and collaboration goals. Risk sharing partners typically engage in joint outcomes and investments, aligning incentives and distributing potential losses, while suppliers usually offer predefined goods or services with fixed costs and limited risk exposure. Evaluating the level of control, accountability, and mutual benefit will help determine if a partnership or a traditional supplier agreement best suits your business strategy.

Best Practices for Managing Partners and Suppliers

Effective risk sharing between partners and suppliers requires clear communication, defined responsibilities, and transparent contractual agreements to mitigate potential disruptions. Implementing joint risk assessments and continuous performance monitoring fosters collaboration and proactive problem-solving. You can enhance supply chain resilience by establishing trust, aligning incentives, and regularly reviewing risk management strategies with both partners and suppliers.

Risk Sharing Partner vs Supplier Infographic

libmatt.com

libmatt.com