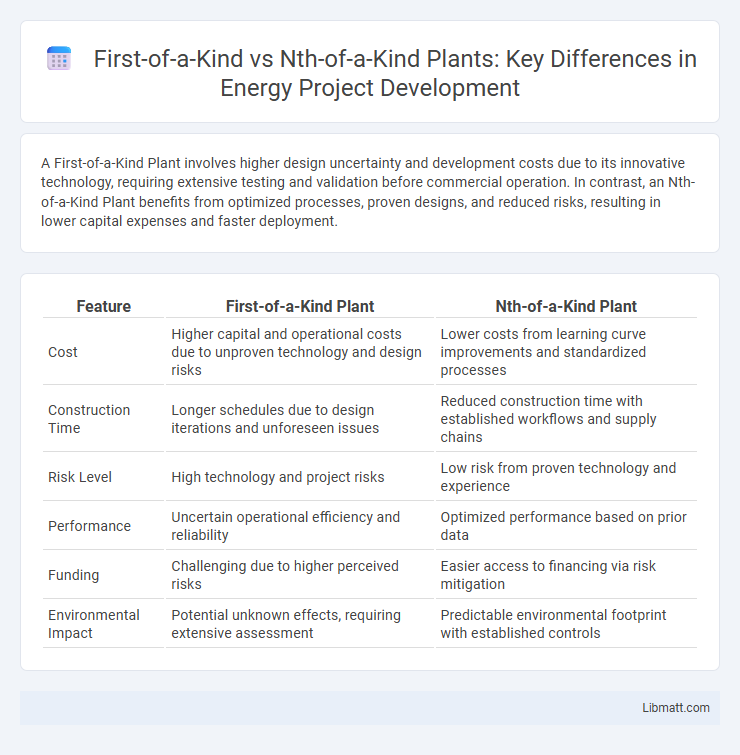

A First-of-a-Kind Plant involves higher design uncertainty and development costs due to its innovative technology, requiring extensive testing and validation before commercial operation. In contrast, an Nth-of-a-Kind Plant benefits from optimized processes, proven designs, and reduced risks, resulting in lower capital expenses and faster deployment.

Table of Comparison

| Feature | First-of-a-Kind Plant | Nth-of-a-Kind Plant |

|---|---|---|

| Cost | Higher capital and operational costs due to unproven technology and design risks | Lower costs from learning curve improvements and standardized processes |

| Construction Time | Longer schedules due to design iterations and unforeseen issues | Reduced construction time with established workflows and supply chains |

| Risk Level | High technology and project risks | Low risk from proven technology and experience |

| Performance | Uncertain operational efficiency and reliability | Optimized performance based on prior data |

| Funding | Challenging due to higher perceived risks | Easier access to financing via risk mitigation |

| Environmental Impact | Potential unknown effects, requiring extensive assessment | Predictable environmental footprint with established controls |

Introduction: Understanding FOAK vs NOAK Plants

First-of-a-Kind (FOAK) plants represent the initial deployment of new technology, facing higher capital costs and operational uncertainties due to unproven design and construction processes. In contrast, Nth-of-a-Kind (NOAK) plants benefit from learning curves, standardized procedures, and economies of scale, resulting in reduced costs and improved performance. Understanding the cost and risk differences between FOAK and NOAK plants is crucial for accurate project planning and investment in innovative energy infrastructure.

Defining First-of-a-Kind (FOAK) Plants

First-of-a-Kind (FOAK) plants represent the initial implementation of a new technology or process at commercial scale, characterized by unique design challenges and higher capital costs due to unproven engineering and lack of operational experience. These plants often require extensive testing and optimization to address unforeseen technical issues, making them riskier but essential for innovation and technology validation. Your investment in a FOAK plant paves the way for subsequent Nth-of-a-Kind (NOAK) plants, which benefit from standardized design, reduced costs, and improved reliability.

Characteristics of Nth-of-a-Kind (NOAK) Plants

Nth-of-a-Kind (NOAK) plants exhibit enhanced operational efficiency and reduced capital costs due to standardized design and accumulated experience from preceding units. Characterized by improved performance reliability, NOAK plants benefit from optimized construction processes, streamlined supply chains, and resolved technical challenges. These advancements contribute to lower risk profiles and accelerated deployment timelines compared to First-of-a-Kind (FOAK) plants.

Key Differences Between FOAK and NOAK Plants

First-of-a-Kind (FOAK) plants are prototype projects characterized by high capital costs, significant design uncertainties, and extensive testing phases, whereas Nth-of-a-Kind (NOAK) plants benefit from standardized designs, optimized processes, and reduced risks due to lessons learned from FOAK implementations. FOAK plants often face longer construction timelines and higher operational challenges, while NOAK plants achieve cost reductions through economies of scale, streamlined supply chains, and improved regulatory compliance. The transition from FOAK to NOAK is critical for technology maturation, cost competitiveness, and wider commercial deployment across industries such as renewable energy, nuclear power, and advanced manufacturing.

Economic Implications: Cost Curves and Learning Rates

First-of-a-kind plants typically face higher capital and operational costs due to unproven technologies and inefficiencies, reflected in steep cost curves during initial deployment. As production scales to nth-of-a-kind plants, learning rates drive cost reductions through improved processes, economies of scale, and technology refinement, flattening the cost curve significantly. Your investment decisions can benefit from understanding these economic implications, as success often hinges on transitioning from costly first-of-a-kind projects to more affordable, mature nth-of-a-kind implementations.

Technical Challenges in FOAK Development

First-of-a-Kind (FOAK) plants face significant technical challenges due to unproven technologies, requiring extensive research, development, and testing to address uncertainties in design, materials, and operational processes. These challenges often lead to higher costs, longer construction times, and increased risk of performance issues compared to Nth-of-a-Kind (NOAK) plants, which benefit from standardized designs, refined processes, and lessons learned from previous deployments. Overcoming FOAK technical obstacles is critical to achieving reliable, scalable, and economically viable systems in subsequent NOAK projects.

Risk Assessment: FOAK vs NOAK Projects

First-of-a-Kind (FOAK) plants face higher risk due to unproven technologies and limited operational data, leading to increased uncertainty in cost, schedule, and performance outcomes. Nth-of-a-Kind (NOAK) plants benefit from reduced risk through design standardization, accumulated operational experience, and improved supply chain efficiency, resulting in lower capital expenditures and enhanced reliability. Effective risk assessment in FOAK projects emphasizes contingency planning and rigorous testing, whereas NOAK assessments leverage empirical data and optimization from previous iterations.

Funding Strategies for FOAK and NOAK Plants

Funding strategies for First-of-a-Kind (FOAK) plants often involve higher financial risk, requiring government grants, public-private partnerships, and risk-sharing mechanisms to attract investors. Financing Nth-of-a-Kind (NOAK) plants benefits from proven technology and operational data, leading to lower capital costs, increased lender confidence, and greater access to commercial loans and equity investments. Capital structures for FOAK projects prioritize innovation and milestone-based capital infusion, while NOAK projects emphasize scalability and cost efficiency to optimize returns.

Real-World Case Studies: FOAK and NOAK in Practice

Real-world case studies of First-of-a-Kind (FOAK) plants highlight challenges such as higher costs, longer construction times, and unanticipated technical issues due to novel technologies and lack of experience. Nth-of-a-Kind (NOAK) plants demonstrate significant improvements in efficiency, reduced costs, and smoother execution by leveraging lessons learned from FOAK projects and standardized processes. Your understanding of these case studies can guide investment decisions and risk assessments in emerging technology deployments.

Future Outlook for Emerging Technologies

First-of-a-kind plants often face higher initial costs, technical uncertainties, and longer development times, impacting the commercial viability of emerging technologies. Nth-of-a-kind plants benefit from learning curves, improved efficiency, and reduced costs, enabling broader market adoption and faster scaling of innovative solutions. Your investment in first-of-a-kind projects contributes to technology maturation, paving the way for more competitive and reliable future deployments.

First-of-a-Kind Plant vs Nth-of-a-Kind Plant Infographic

libmatt.com

libmatt.com