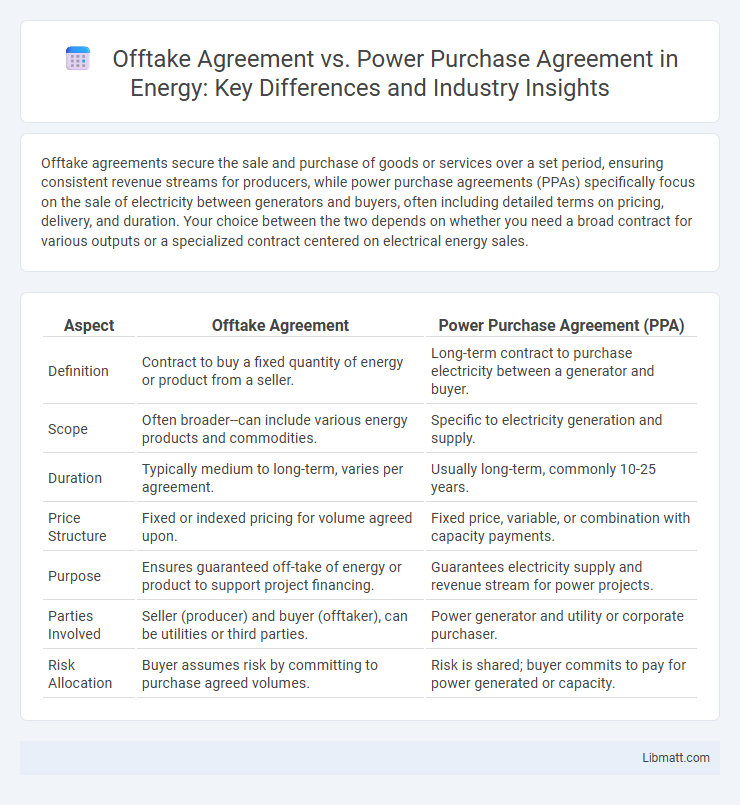

Offtake agreements secure the sale and purchase of goods or services over a set period, ensuring consistent revenue streams for producers, while power purchase agreements (PPAs) specifically focus on the sale of electricity between generators and buyers, often including detailed terms on pricing, delivery, and duration. Your choice between the two depends on whether you need a broad contract for various outputs or a specialized contract centered on electrical energy sales.

Table of Comparison

| Aspect | Offtake Agreement | Power Purchase Agreement (PPA) |

|---|---|---|

| Definition | Contract to buy a fixed quantity of energy or product from a seller. | Long-term contract to purchase electricity between a generator and buyer. |

| Scope | Often broader--can include various energy products and commodities. | Specific to electricity generation and supply. |

| Duration | Typically medium to long-term, varies per agreement. | Usually long-term, commonly 10-25 years. |

| Price Structure | Fixed or indexed pricing for volume agreed upon. | Fixed price, variable, or combination with capacity payments. |

| Purpose | Ensures guaranteed off-take of energy or product to support project financing. | Guarantees electricity supply and revenue stream for power projects. |

| Parties Involved | Seller (producer) and buyer (offtaker), can be utilities or third parties. | Power generator and utility or corporate purchaser. |

| Risk Allocation | Buyer assumes risk by committing to purchase agreed volumes. | Risk is shared; buyer commits to pay for power generated or capacity. |

Introduction to Offtake Agreements and Power Purchase Agreements

Offtake agreements and power purchase agreements (PPAs) are critical contracts in energy project financing, defining the terms for the sale and purchase of electricity or other products generated by a project. Offtake agreements encompass a broader range of commodities and services, securing the buyer's commitment to purchase a specified amount over a certain period, while PPAs specifically address the sale of electricity between a power producer and a buyer such as a utility or large consumer. Understanding the distinctions helps you negotiate contracts that ensure financial viability and long-term operational stability of energy projects.

Definition of Offtake Agreements

Offtake agreements are legally binding contracts between a producer and a buyer outlining the purchase of a product before production begins, ensuring a guaranteed market and revenue stream for the supplier. In energy projects, these agreements secure the sale of power, commodities, or raw materials, often serving as critical financing tools by reducing market risk. Unlike power purchase agreements (PPAs), which specifically pertain to electricity sales, offtake agreements encompass a broader range of goods and commodities.

Definition of Power Purchase Agreements (PPAs)

Power Purchase Agreements (PPAs) are legally binding contracts between electricity generators and purchasers, typically utilities or large energy consumers, detailing the terms for the sale and purchase of electricity over a specified duration. PPAs define pricing structures, delivery schedules, and volume commitments, ensuring revenue certainty for producers and cost predictability for buyers. These agreements are fundamental in renewable energy markets, facilitating project financing and fostering long-term energy procurement strategies.

Key Differences Between Offtake Agreements and PPAs

Offtake agreements primarily involve the sale and purchase of goods or commodities between producers and buyers, while Power Purchase Agreements (PPAs) are specific contracts for the sale of electricity from energy producers to consumers or utilities. Offtake agreements often cover a broader range of products and can include long-term purchase commitments, whereas PPAs are tailored to the energy sector, addressing elements like energy delivery schedules, pricing structures, and grid interconnection requirements. Understanding these distinctions helps you negotiate terms that align with your operational and financial objectives in either commodity markets or energy projects.

Legal Framework and Contract Structure

Offtake agreements and power purchase agreements (PPAs) both establish legally binding contracts for energy sales, but PPAs typically involve more detailed stipulations regarding regulatory compliance, tariff structures, and grid interconnection requirements under energy-specific legal frameworks. The contract structure of an offtake agreement is often broader and more flexible, covering various commodities or products, whereas PPAs are highly specialized, with precise terms concerning energy delivery schedules, pricing mechanisms, and performance guarantees tailored to electricity markets. Understanding the distinct legal frameworks and contractual elements in your energy procurement or project development is crucial for effective risk management and regulatory adherence.

Market Applications: Industries and Energy Sector

Offtake agreements are commonly used in industries such as mining, agriculture, and manufacturing to secure the long-term sale of raw materials or products, providing financial stability and market certainty. Power purchase agreements (PPAs) are prevalent in the energy sector, especially for renewable energy projects like solar and wind farms, enabling utilities and corporations to buy electricity directly from producers at predetermined rates. Your choice between these agreements depends on whether you need to manage physical goods supply chains or energy procurement for operational efficiency and cost control.

Risk Allocation and Credit Considerations

Offtake agreements and power purchase agreements (PPAs) differ significantly in risk allocation and credit considerations; offtake agreements typically allocate volume and price risks more evenly between parties, while PPAs often place greater performance risk on the seller. Creditworthiness of the offtaker in PPAs is critical because the buyer commits to long-term payments, influencing project financing and bankability. Offtake agreements may involve shorter terms and more flexible structures, potentially reducing credit risk but increasing price uncertainty for energy producers.

Pricing Mechanisms and Payment Terms

Offtake agreements and power purchase agreements (PPAs) differ primarily in their pricing mechanisms and payment terms, with offtake agreements often using fixed or indexed prices based on project costs or market benchmarks, while PPAs typically feature long-term fixed or variable rates tied to energy delivery. Payment terms in offtake agreements may include milestone payments or volume-based settlements, whereas PPAs generally involve regular, scheduled payments aligned with the actual electricity produced and delivered. Understanding these distinctions helps you negotiate terms that secure stable revenue streams and better risk allocation in energy projects.

Advantages and Disadvantages of Each Agreement

Offtake agreements provide the advantage of securing a guaranteed buyer for your product, reducing market risk, but they may limit flexibility in pricing and contract terms. Power purchase agreements (PPAs) offer long-term price stability and financial predictability for your energy projects, though they often involve complex negotiations and potential regulatory challenges. Choosing between these agreements depends on your priorities regarding risk management, pricing control, and contract duration.

Choosing the Right Agreement for Your Project

Choosing the right agreement between an Offtake Agreement and a Power Purchase Agreement (PPA) depends on your project's specific energy production and sales needs. An Offtake Agreement generally covers broader commodities or energy outputs, providing flexibility, while a PPA is specifically tailored for the sale of electricity, often featuring fixed pricing and long-term commitments. Evaluating factors like contract duration, pricing structure, and regulatory environment can help ensure your project's financial stability and operational efficiency.

Offtake agreement vs Power purchase agreement Infographic

libmatt.com

libmatt.com