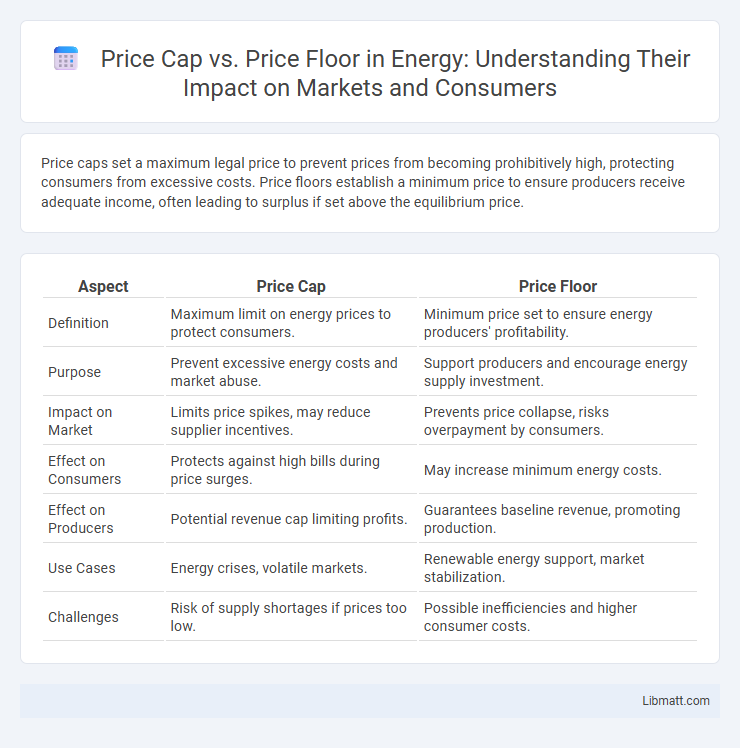

Price caps set a maximum legal price to prevent prices from becoming prohibitively high, protecting consumers from excessive costs. Price floors establish a minimum price to ensure producers receive adequate income, often leading to surplus if set above the equilibrium price.

Table of Comparison

| Aspect | Price Cap | Price Floor |

|---|---|---|

| Definition | Maximum limit on energy prices to protect consumers. | Minimum price set to ensure energy producers' profitability. |

| Purpose | Prevent excessive energy costs and market abuse. | Support producers and encourage energy supply investment. |

| Impact on Market | Limits price spikes, may reduce supplier incentives. | Prevents price collapse, risks overpayment by consumers. |

| Effect on Consumers | Protects against high bills during price surges. | May increase minimum energy costs. |

| Effect on Producers | Potential revenue cap limiting profits. | Guarantees baseline revenue, promoting production. |

| Use Cases | Energy crises, volatile markets. | Renewable energy support, market stabilization. |

| Challenges | Risk of supply shortages if prices too low. | Possible inefficiencies and higher consumer costs. |

Introduction to Price Regulation Mechanisms

Price caps limit the maximum price sellers can charge to protect consumers from excessively high prices, commonly used in utilities and essential services. Price floors set a minimum price to ensure producers receive a fair income, frequently applied in agriculture and labor markets such as minimum wage laws. These price regulation mechanisms balance market efficiency and social welfare by controlling prices to prevent market failures.

Defining Price Caps and Price Floors

Price caps are government-imposed limits on the maximum price that can be charged for goods or services, designed to protect consumers from excessively high prices. Price floors set the minimum price that must be paid, ensuring producers receive a fair income, commonly seen in markets like agriculture or labor wages. Understanding how price caps and price floors function helps you grasp their impact on market equilibrium and economic efficiency.

Economic Rationale Behind Price Controls

Price caps are implemented to prevent prices from rising above a level that would restrict consumer access to essential goods, ensuring affordability during shortages or market power imbalances. Price floors guarantee producers a minimum income by setting prices above equilibrium, aiming to sustain industries like agriculture or labor markets. Your understanding of these controls highlights the balance policymakers seek between protecting consumers and supporting producers while maintaining market stability.

Key Differences Between Price Caps and Price Floors

Price caps set the maximum price that can be charged for a good or service, preventing prices from rising above a specified level. Price floors establish the minimum price, ensuring that prices do not fall below a certain threshold to protect suppliers' income. Understanding the key differences between price caps and price floors helps you evaluate their impact on market equilibrium, supply, and demand dynamics.

Real-World Examples of Price Caps

Price caps are regulatory limits set on the maximum price of essential goods or services to protect consumers from exorbitant costs, commonly seen in utilities like electricity and water. For instance, the United Kingdom enforces a price cap on energy tariffs through the Energy Price Cap set by Ofgem, limiting how much suppliers can charge households per unit of electricity or gas. Another example is rent control policies in cities like New York, where price ceilings on rental units prevent landlords from imposing excessive rent increases, ensuring affordable housing options.

Real-World Examples of Price Floors

Real-world examples of price floors include minimum wage laws, where governments set the lowest legal pay to protect workers' earnings, and agricultural price supports, designed to ensure farmers receive a minimum price for their crops or livestock. These price floors can lead to surpluses when producers supply more than consumers demand at the set minimum price. Understanding how price floors impact markets helps you anticipate potential effects on supply, demand, and market equilibrium in various industries.

Market Impacts of Price Ceilings

Price ceilings set a maximum limit on prices, often leading to shortages as demand exceeds supply due to artificially low prices. This intervention distorts market equilibrium, reducing producer incentives and causing inefficiencies such as black markets or reduced product quality. You may face limited availability of goods or services when price caps disrupt natural market forces.

Market Impacts of Price Floors

Price floors set a minimum price above the equilibrium, often leading to surplus supply as producers supply more while consumers demand less. These market distortions can result in wasted resources, as excess goods remain unsold or require government purchase programs to stabilize the market. You may face higher prices and reduced product availability when price floors artificially inflate costs.

Advantages and Disadvantages of Price Controls

Price caps prevent prices from exceeding a maximum limit, making essential goods more affordable but can cause shortages and reduced supply incentives. Price floors set a minimum price to protect producers, ensuring fair income but might lead to surpluses and inefficiencies in the market. Both controls can distort market equilibrium, affecting consumer choice and producer profitability.

Policy Considerations and Future Outlook

Price cap policies aim to protect consumers by limiting how much prices can rise, often leading to increased affordability but potential supply constraints. Price floors guarantee minimum prices to producers, supporting income stability but risking surpluses and market inefficiencies. Future outlooks emphasize adaptive mechanisms integrating data analytics to balance market stability with consumer welfare amid evolving economic conditions.

Price Cap vs Price Floor Infographic

libmatt.com

libmatt.com