OBC (Old Book Credit) and NFO (New Fund Offer) are key investment options with OBC allowing investors to trade existing mutual fund units on the secondary market, whereas NFO provides an opportunity to invest in a newly launched mutual fund at the initial offering price. Understanding these differences helps you decide whether to buy into an ongoing fund or participate at the inception to potentially capture early growth benefits.

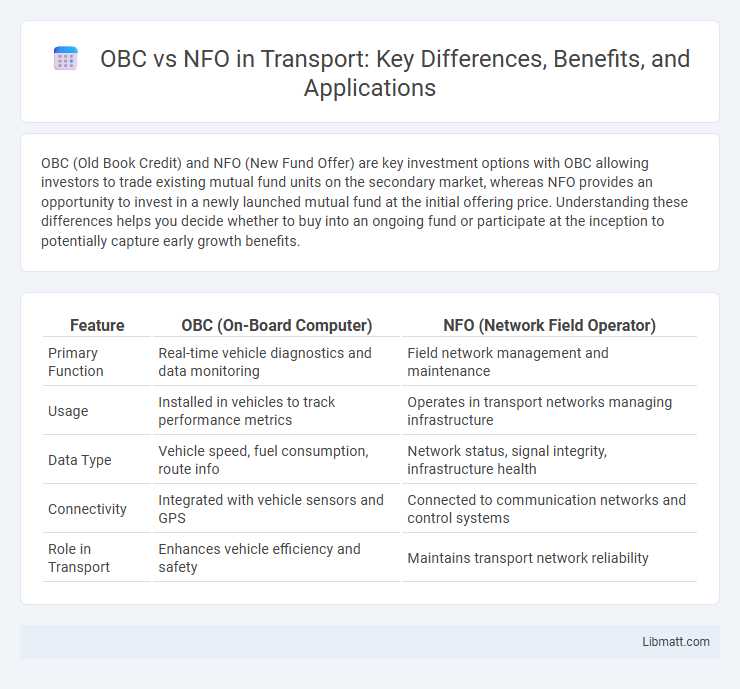

Table of Comparison

| Feature | OBC (On-Board Computer) | NFO (Network Field Operator) |

|---|---|---|

| Primary Function | Real-time vehicle diagnostics and data monitoring | Field network management and maintenance |

| Usage | Installed in vehicles to track performance metrics | Operates in transport networks managing infrastructure |

| Data Type | Vehicle speed, fuel consumption, route info | Network status, signal integrity, infrastructure health |

| Connectivity | Integrated with vehicle sensors and GPS | Connected to communication networks and control systems |

| Role in Transport | Enhances vehicle efficiency and safety | Maintains transport network reliability |

Introduction to OBC and NFO

OBC (Overseas Citizen of India) and NFO (New Fund Offer) serve distinct purposes; OBC is a lifelong visa scheme allowing foreign nationals of Indian origin to live and work in India, while NFO refers to the initial subscription period of a new mutual fund scheme introduced to investors. The OBC card offers benefits similar to residency without granting full citizenship, facilitating easier access to India's financial, educational, and property sectors. NFOs attract investors by launching new investment opportunities with potentially higher future returns, crucial for mutual fund companies to raise capital and expand their portfolio offerings.

Definition: What is OBC?

OBC, or Old Bill of Charges, refers to a pre-existing billing structure used by telecom operators to calculate call rates before introducing new pricing models. It serves as a benchmark to compare against NFO, or New Fee Order, which implements updated tariffs and service fees. Understanding OBC is crucial for analyzing historical billing trends and the impact of regulatory changes on customer charges.

Definition: What is NFO?

An NFO (New Fund Offer) refers to the initial subscription period when a mutual fund launches a new scheme, allowing investors to purchase units at the offer price. OBC (Open-ended Fund Offer) describes a fund type where investors can buy or redeem units at NAV anytime post-launch, unlike the fixed subscription window in NFOs. Understanding these distinctions helps you decide when and how to invest effectively in mutual funds.

Key Differences Between OBC and NFO

OBC (Original Bank Certificate) serves as proof of funds or financial standing issued by a bank, whereas NFO (New Fund Offer) refers to the initial offering of units in a new mutual fund scheme. OBC is primarily used in banking and loan processes to verify your financial credibility, while NFO is an investment opportunity allowing you to subscribe to a new fund at the launch price. Understanding these key differences helps in distinguishing financial documentation from investment options in your financial planning.

Advantages of Investing in OBC

Investing in Offshore Banking Companies (OBC) offers significant advantages such as enhanced asset protection, tax efficiency, and greater privacy compared to Non-Fund Offerings (NFO). You benefit from diversified investment opportunities and easier access to international markets, which can boost portfolio growth and reduce regional risk. OBCs also provide more flexible banking services, making them a preferred choice for global investors seeking optimized financial management.

Benefits of Participating in NFO

Participating in a New Fund Offer (NFO) allows you to invest at the initial offering price, often lower than existing market prices, maximizing potential returns. NFOs provide the opportunity to enter new investment themes or sectors early, benefiting from the fund manager's fresh strategy and market insights. Early investors in NFOs also enjoy clarity on fund objectives and portfolio composition without the uncertainty of past performance.

Risks Associated with OBC Investments

Investing in OBC (Open Banking Certificates) carries risks such as market volatility, regulatory changes, and potential cybersecurity threats that could impact your returns. Unlike NFOs (New Fund Offers), OBCs may lack extensive historical performance data, making it harder to predict future outcomes. It is crucial to thoroughly assess these risks before committing your funds to OBC investments.

Potential Risks in NFO Investments

Investing in New Fund Offers (NFOs) carries potential risks including limited performance data, as these funds lack a historical track record, making it difficult for You to assess their future returns accurately. The fund's scheme objective and management expertise may not align with Your investment goals, increasing the risk of underperformance. Market timing and subscription pressure during the NFO launch can also affect initial NAV, impacting Your overall investment value.

OBC vs NFO: Which Should You Choose?

Choosing between OBC (Open-Book Course) and NFO (New Fund Offer) depends on your investment goals and risk tolerance. OBC offers established performance data and liquidity, making it suitable for risk-averse investors seeking stability. NFO allows investing in new funds with potential for higher returns but involves higher uncertainty due to lack of historical data.

Conclusion: Making the Right Investment Decision

Choosing between an OBC (Offer Before Close) and an NFO (New Fund Offer) depends on your investment goals, risk tolerance, and market conditions, as OBCs often provide a streamlined opportunity to invest in established funds, whereas NFOs introduce new schemes with potential but higher uncertainty. Assessing factors like fund performance history, management expertise, and exit load structures is crucial for informed decision-making. Your ability to evaluate these elements will ensure you select the investment that aligns with your financial objectives and risk appetite.

OBC vs NFO Infographic

libmatt.com

libmatt.com