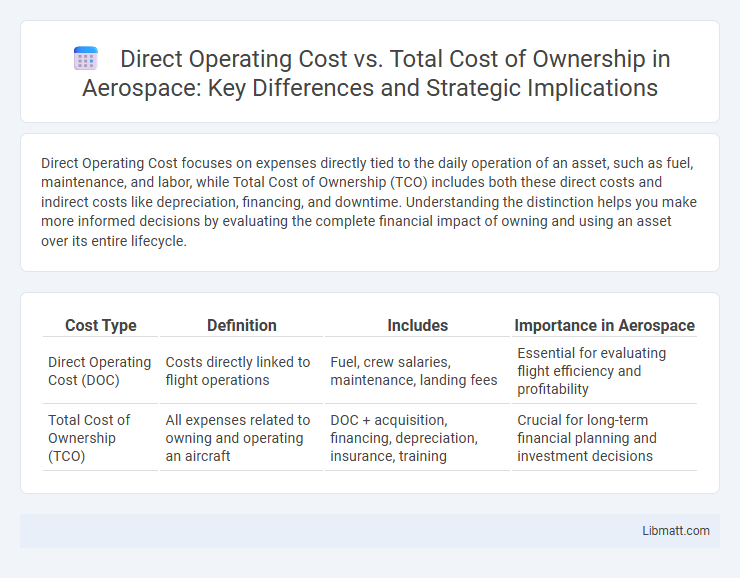

Direct Operating Cost focuses on expenses directly tied to the daily operation of an asset, such as fuel, maintenance, and labor, while Total Cost of Ownership (TCO) includes both these direct costs and indirect costs like depreciation, financing, and downtime. Understanding the distinction helps you make more informed decisions by evaluating the complete financial impact of owning and using an asset over its entire lifecycle.

Table of Comparison

| Cost Type | Definition | Includes | Importance in Aerospace |

|---|---|---|---|

| Direct Operating Cost (DOC) | Costs directly linked to flight operations | Fuel, crew salaries, maintenance, landing fees | Essential for evaluating flight efficiency and profitability |

| Total Cost of Ownership (TCO) | All expenses related to owning and operating an aircraft | DOC + acquisition, financing, depreciation, insurance, training | Crucial for long-term financial planning and investment decisions |

Introduction to Direct Operating Cost and Total Cost of Ownership

Direct Operating Cost (DOC) represents the immediate expenses related to the operation of an asset, such as fuel, maintenance, and labor, critical for understanding daily financial impact. Total Cost of Ownership (TCO) includes all costs associated with acquiring, operating, maintaining, and disposing of an asset over its entire lifecycle, offering a comprehensive financial overview. Understanding both DOC and TCO helps you make informed decisions about cost management and investment efficiency.

Key Definitions: DOC vs TCO

Direct Operating Cost (DOC) refers to the immediate expenses associated with operating an asset, such as fuel, maintenance, and crew costs. Total Cost of Ownership (TCO) encompasses DOC along with indirect and fixed costs, including acquisition, depreciation, insurance, and downtime expenses, providing a comprehensive view of the asset's overall financial impact. Understanding DOC versus TCO is essential for accurately assessing long-term investment decisions and operational efficiency.

Components of Direct Operating Cost

Direct Operating Cost (DOC) includes variable expenses directly tied to daily operations such as fuel, maintenance, crew salaries, and landing fees, all critical in managing your aircraft's immediate financial performance. These components differ from Total Cost of Ownership (TCO), which also encompasses fixed costs like insurance, depreciation, and financing charges spread over the asset's lifecycle. Understanding the precise elements of DOC enables more accurate budgeting and operational decision-making within the broader context of TCO.

Elements Included in Total Cost of Ownership

Total Cost of Ownership (TCO) includes direct operating costs such as fuel, maintenance, and repairs, along with indirect expenses like depreciation, insurance, taxes, and downtime losses. It also accounts for financing charges, training, and disposal costs, providing a comprehensive view of your investment's financial impact over its lifecycle. Understanding these elements helps you make informed decisions by comparing TCO to the more limited scope of direct operating costs.

Calculation Methods for DOC and TCO

Calculation methods for Direct Operating Cost (DOC) focus on variable expenses such as fuel, maintenance, and crew wages directly associated with aircraft operation per flight hour or cycle. Total Cost of Ownership (TCO) encompasses DOC plus fixed costs like acquisition price, insurance, depreciation, and financing over the asset's lifecycle, calculated using amortization and present value techniques. Understanding these methods allows you to accurately assess both immediate operational expenses and long-term financial commitments.

Industry Examples Comparing DOC and TCO

In the aviation industry, Direct Operating Cost (DOC) includes fuel, maintenance, and crew expenses, while Total Cost of Ownership (TCO) encompasses DOC plus acquisition, financing, and depreciation costs, providing a comprehensive financial perspective. Similarly, in the automotive sector, DOC covers fuel and routine maintenance, whereas TCO accounts for insurance, taxes, and resale value, offering a holistic view for fleet managers. Understanding the balance between DOC and TCO helps you make informed decisions about investing in assets with long-term economic efficiency.

Financial Implications for Decision-Makers

Direct Operating Cost represents the immediate expenses like fuel, maintenance, and crew salaries, directly impacting your short-term cash flow and budgeting decisions. Total Cost of Ownership encompasses these direct costs plus indirect expenses such as depreciation, insurance, and financing, providing a comprehensive view of long-term financial commitments. Decision-makers benefit from analyzing both metrics to optimize asset utilization, manage risk, and improve strategic financial planning.

Common Misconceptions Between DOC and TCO

Common misconceptions between Direct Operating Cost (DOC) and Total Cost of Ownership (TCO) often arise from confusing short-term expenses with long-term financial impact. DOC typically includes immediate, variable expenses such as fuel, maintenance, and crew salaries, whereas TCO encompasses these costs plus fixed expenses like depreciation, insurance, and financing over the asset's lifespan. Understanding the distinction helps you make more informed decisions by evaluating both the ongoing operational costs and the broader investment implications for accurate budgeting and financial planning.

Strategies to Minimize DOC and TCO

Reducing Direct Operating Cost (DOC) and Total Cost of Ownership (TCO) requires strategic asset management, including regular preventive maintenance and energy-efficient upgrades to extend equipment lifespan and lower repair expenses. Implementing advanced monitoring technologies enables proactive identification of issues, minimizing downtime and optimizing operational efficiency. You can further minimize costs by negotiating supplier contracts and adopting lifecycle cost analysis to prioritize investments that deliver the best long-term value.

Conclusion: Choosing the Right Cost Metric

Choosing the right cost metric depends on your specific financial goals and operational priorities. Direct Operating Cost offers a clear view of immediate expenses, such as fuel, maintenance, and labor, while Total Cost of Ownership incorporates long-term factors like depreciation, insurance, and financing. Understanding these distinctions ensures accurate budgeting and strategic asset management tailored to your unique business needs.

Direct Operating Cost vs Total Cost of Ownership Infographic

libmatt.com

libmatt.com