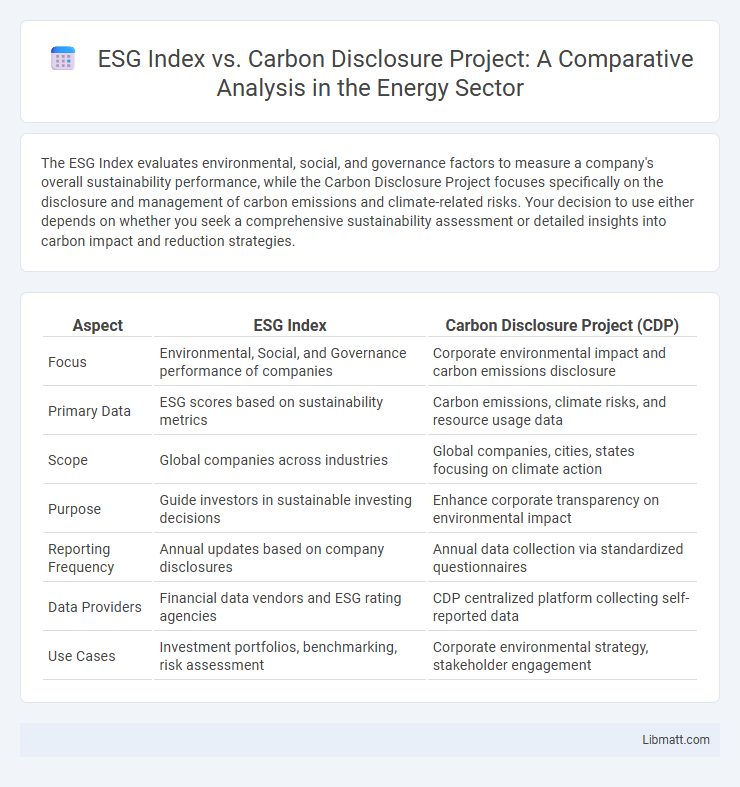

The ESG Index evaluates environmental, social, and governance factors to measure a company's overall sustainability performance, while the Carbon Disclosure Project focuses specifically on the disclosure and management of carbon emissions and climate-related risks. Your decision to use either depends on whether you seek a comprehensive sustainability assessment or detailed insights into carbon impact and reduction strategies.

Table of Comparison

| Aspect | ESG Index | Carbon Disclosure Project (CDP) |

|---|---|---|

| Focus | Environmental, Social, and Governance performance of companies | Corporate environmental impact and carbon emissions disclosure |

| Primary Data | ESG scores based on sustainability metrics | Carbon emissions, climate risks, and resource usage data |

| Scope | Global companies across industries | Global companies, cities, states focusing on climate action |

| Purpose | Guide investors in sustainable investing decisions | Enhance corporate transparency on environmental impact |

| Reporting Frequency | Annual updates based on company disclosures | Annual data collection via standardized questionnaires |

| Data Providers | Financial data vendors and ESG rating agencies | CDP centralized platform collecting self-reported data |

| Use Cases | Investment portfolios, benchmarking, risk assessment | Corporate environmental strategy, stakeholder engagement |

Introduction to ESG Index and Carbon Disclosure Project

The ESG Index evaluates companies based on environmental, social, and governance criteria to help investors identify sustainable and ethical investment opportunities. The Carbon Disclosure Project (CDP) collects detailed environmental data, primarily focusing on carbon emissions and climate risk disclosure from corporations worldwide. Understanding both the ESG Index and CDP can enhance your ability to assess corporate sustainability performance effectively.

Defining ESG Index: Key Components and Metrics

The ESG Index measures corporate performance across environmental, social, and governance criteria, incorporating metrics such as carbon emissions, labor practices, board diversity, and ethical governance. It evaluates companies based on quantitative data like energy consumption and qualitative factors including stakeholder engagement and transparency. By contrast, the Carbon Disclosure Project specializes in collecting and publishing detailed data specifically on carbon emissions and climate-related risks, supporting broader ESG frameworks but with a focused environmental scope.

Understanding the Carbon Disclosure Project (CDP)

The Carbon Disclosure Project (CDP) is a globally recognized non-profit organization that collects and publishes detailed environmental data from thousands of companies, focusing on carbon emissions, water usage, and deforestation. Unlike broader ESG indices that evaluate environmental, social, and governance factors collectively, CDP specializes in transparent carbon reporting and climate risk management, enabling investors to assess a company's environmental performance with precision. Your understanding of CDP can enhance insight into corporate environmental impact and support informed decisions based on verifiable carbon disclosure metrics.

Methodologies: How ESG Index and CDP Assess Companies

ESG Index evaluates companies using a comprehensive framework incorporating environmental, social, and governance criteria with quantitative metrics and qualitative analysis to score corporate sustainability performance. The Carbon Disclosure Project (CDP) focuses primarily on environmental transparency by collecting self-reported data on carbon emissions, water usage, and climate risk from companies globally, using standardized questionnaires vetted by experts. ESG Indexes aggregate multiple data sources, including CDP disclosures, to provide broader sustainability assessments, while CDP emphasizes detailed carbon and environmental impact disclosure to drive investor and regulatory decisions.

Data Sources: ESG Index vs CDP Transparency

ESG Indexes aggregate data from diverse sources including corporate reports, regulatory filings, and third-party ratings to evaluate environmental, social, and governance performance comprehensively. The Carbon Disclosure Project (CDP) relies heavily on self-reported data directly from companies through detailed questionnaires, emphasizing transparency and standardized climate-related disclosures. While ESG Indexes integrate multiple data inputs for broader analysis, CDP's transparency is grounded in its rigorous disclosure framework, promoting accountability in carbon emissions and environmental impact reporting.

Scope of Evaluation: ESG Index versus CDP Coverage

The ESG Index evaluates companies based on environmental, social, and governance criteria, offering a broad assessment of corporate sustainability practices across multiple dimensions. In contrast, the Carbon Disclosure Project (CDP) specializes in detailed reporting on climate-related metrics, primarily focusing on carbon emissions, water usage, and forest impact. While the ESG Index provides a holistic view of corporate responsibility, the CDP delivers in-depth insights specifically on environmental data, facilitating targeted climate risk management and disclosure.

Impact on Corporate Strategy and Reporting

The ESG Index and Carbon Disclosure Project serve as critical frameworks influencing corporate strategy and reporting by emphasizing environmental, social, and governance metrics alongside detailed carbon emissions data. Companies integrate these tools to enhance transparency, drive sustainable practices, and align business goals with stakeholder expectations and regulatory requirements. Your organization's strategic planning benefits from leveraging insights from both frameworks to improve risk management, investor confidence, and long-term value creation.

Investor Perspectives: ESG Index and CDP Integration

Investors increasingly integrate ESG Index metrics with Carbon Disclosure Project (CDP) data to gain a comprehensive view of corporate sustainability and climate risk. The ESG Index provides broad environmental, social, and governance performance scores, while CDP delivers detailed disclosures on carbon emissions and climate strategies. Combining these resources enhances Your ability to assess long-term investment risks and identify companies with strong commitments to environmental transparency and sustainable practices.

Challenges and Limitations: ESG Index vs CDP

ESG Index and Carbon Disclosure Project (CDP) face distinct challenges in measuring corporate sustainability and environmental impact. ESG Indexes often struggle with data consistency and transparency due to varied reporting standards across industries and regions, while CDP relies heavily on voluntary disclosure, resulting in potential gaps and self-reporting bias in carbon emissions data. Your ability to make informed decisions may be impacted by these limitations, requiring critical evaluation of both sources for a comprehensive sustainability assessment.

Future Trends in ESG Index and CDP Adoption

ESG Index adoption is projected to grow with increasing integration of artificial intelligence and big data analytics, enhancing transparency and real-time sustainability assessment for investors. The Carbon Disclosure Project (CDP) is expanding its influence by broadening sector coverage and deepening data granularity, enabling more precise climate risk management and regulatory compliance. Both frameworks are evolving to meet stricter environmental reporting standards and investor demand for comprehensive, actionable ESG insights.

ESG Index vs Carbon Disclosure Project Infographic

libmatt.com

libmatt.com