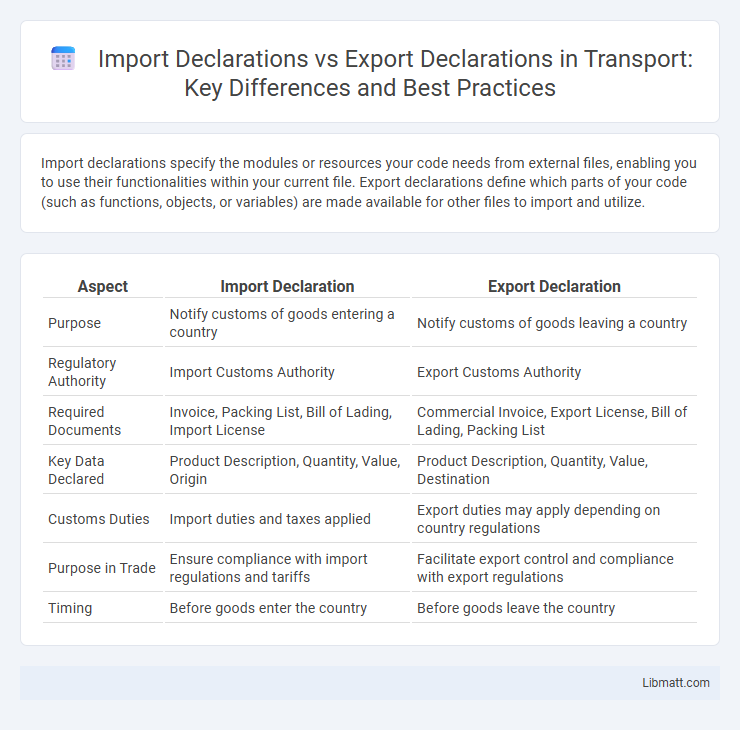

Import declarations specify the modules or resources your code needs from external files, enabling you to use their functionalities within your current file. Export declarations define which parts of your code (such as functions, objects, or variables) are made available for other files to import and utilize.

Table of Comparison

| Aspect | Import Declaration | Export Declaration |

|---|---|---|

| Purpose | Notify customs of goods entering a country | Notify customs of goods leaving a country |

| Regulatory Authority | Import Customs Authority | Export Customs Authority |

| Required Documents | Invoice, Packing List, Bill of Lading, Import License | Commercial Invoice, Export License, Bill of Lading, Packing List |

| Key Data Declared | Product Description, Quantity, Value, Origin | Product Description, Quantity, Value, Destination |

| Customs Duties | Import duties and taxes applied | Export duties may apply depending on country regulations |

| Purpose in Trade | Ensure compliance with import regulations and tariffs | Facilitate export control and compliance with export regulations |

| Timing | Before goods enter the country | Before goods leave the country |

Introduction to Import and Export Declarations

Import declarations require detailed documentation of goods entering a country to comply with customs regulations and ensure accurate tariff application. Export declarations provide information about goods leaving a country, facilitating compliance with export controls and enabling trade statistics collection. Both declarations play critical roles in international trade by ensuring legal compliance and accurate documentation for importers, exporters, and customs authorities.

Defining Import Declarations

Import declarations are official documents submitted by importers to customs authorities, detailing goods brought into a country. Your import declaration includes critical data such as product descriptions, quantities, values, and origin to ensure compliance with import regulations and tariff assessment. Understanding the precise requirements of import declarations helps streamline customs clearance and avoid delays or penalties.

Defining Export Declarations

Export declarations are official documents required by customs authorities to provide detailed information about goods leaving a country, including product descriptions, quantities, values, and shipment details. These declarations facilitate legal compliance, enable export controls, and support trade statistics collection. Your timely and accurate submission of export declarations ensures smooth customs clearance and avoids penalties or shipment delays.

Key Differences Between Import and Export Declarations

Import declarations require detailed information about goods entering a country, including tariff codes, origin, and value, to calculate duties and comply with customs regulations. Export declarations focus on the documentation of goods leaving a country, emphasizing export control laws, destination, and export licensing requirements. Both declarations facilitate trade compliance but differ mainly in regulatory focus and the direction of goods movement.

Legal Requirements for Import Declarations

Import declarations are mandatory documents required by customs authorities to verify the legality and compliance of goods entering a country, including detailed information such as the importer's identity, product description, quantity, value, and origin. Legal requirements for import declarations often involve adherence to tariffs, import quotas, licensing, health and safety standards, and proper classification under the Harmonized System (HS) codes to ensure correct duty and tax assessments. Failure to comply with these legal requirements can lead to penalties, shipment delays, or seizure of goods, making accurate and timely import declarations crucial for international trade compliance.

Legal Requirements for Export Declarations

Export declarations must comply with stringent legal requirements set by customs authorities, including accurate documentation of goods, their value, and destination to ensure lawful exportation and avoid penalties. Exporters are required to provide detailed information such as export licenses, commercial invoices, and packing lists, adhering to international trade regulations and bilateral agreements. Failure to meet these legal obligations can result in shipment delays, fines, or confiscation of goods.

Documentation Needed for Import and Export Declarations

Import declarations require documents such as the commercial invoice, bill of lading, packing list, and import permits to ensure accurate customs processing and compliance with local regulations. Export declarations demand similar paperwork, including export licenses, commercial invoices, packing lists, and certificates of origin to verify shipment details and adhere to export controls. Ensuring your documentation is complete and accurate facilitates smoother customs clearance and avoids potential delays or penalties.

Role in International Trade Compliance

Import declarations ensure that goods entering a country comply with local customs regulations, tariffs, and safety standards, facilitating legal and efficient customs clearance. Export declarations provide authorities with critical information on goods leaving the country, helping to enforce export controls, trade sanctions, and accurate statistical data collection. Both declarations are essential for maintaining transparent, lawful international trade and minimizing risks of violations or delays.

Common Challenges and Mistakes

Import declarations and export declarations frequently encounter challenges such as inaccurate documentation, incorrect tariff codes, and non-compliance with customs regulations. Misclassification of goods and incomplete declaration forms often result in costly delays, fines, and shipment seizures. Proper training in customs procedures and continuous updates on regulatory changes are essential to minimize errors in both import and export processes.

Best Practices for Accurate Declarations

Accurate import and export declarations are essential to ensure compliance with customs regulations and avoid penalties or shipment delays. Best practices include thoroughly verifying product descriptions, HS codes, and valuation details, maintaining consistent documentation across all parties, and using automated customs software to minimize human errors. Regular training for staff on updated legal requirements and conducting internal audits further enhance the accuracy and reliability of trade declarations.

import declaration vs export declaration Infographic

libmatt.com

libmatt.com