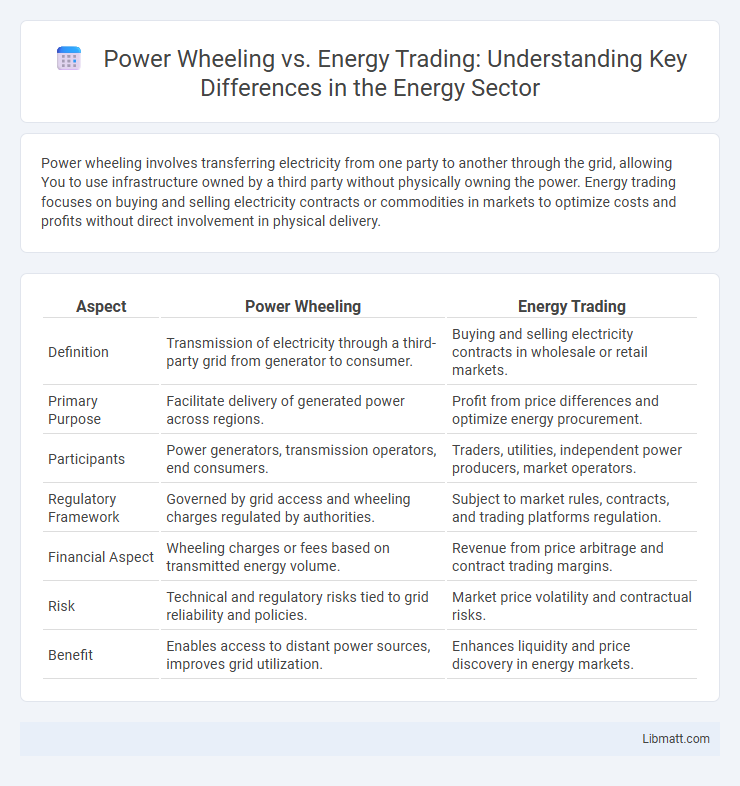

Power wheeling involves transferring electricity from one party to another through the grid, allowing You to use infrastructure owned by a third party without physically owning the power. Energy trading focuses on buying and selling electricity contracts or commodities in markets to optimize costs and profits without direct involvement in physical delivery.

Table of Comparison

| Aspect | Power Wheeling | Energy Trading |

|---|---|---|

| Definition | Transmission of electricity through a third-party grid from generator to consumer. | Buying and selling electricity contracts in wholesale or retail markets. |

| Primary Purpose | Facilitate delivery of generated power across regions. | Profit from price differences and optimize energy procurement. |

| Participants | Power generators, transmission operators, end consumers. | Traders, utilities, independent power producers, market operators. |

| Regulatory Framework | Governed by grid access and wheeling charges regulated by authorities. | Subject to market rules, contracts, and trading platforms regulation. |

| Financial Aspect | Wheeling charges or fees based on transmitted energy volume. | Revenue from price arbitrage and contract trading margins. |

| Risk | Technical and regulatory risks tied to grid reliability and policies. | Market price volatility and contractual risks. |

| Benefit | Enables access to distant power sources, improves grid utilization. | Enhances liquidity and price discovery in energy markets. |

Introduction to Power Wheeling and Energy Trading

Power wheeling involves the transmission of electricity through the grid from a producer to an end-user, enabling efficient distribution across different regions without owning the transmission lines. Energy trading focuses on buying and selling electricity contracts in wholesale markets to capitalize on price fluctuations and manage supply and demand. Understanding the distinctions between power wheeling and energy trading helps you optimize energy procurement strategies and reduce operational costs.

Definitions: Power Wheeling Explained

Power wheeling involves the transmission of electricity through the grid from one party to another without ownership transfer, allowing users to move their generated power to different locations efficiently. Energy trading refers to the buying and selling of electricity or energy commodities in various markets to optimize costs and supply. Understanding power wheeling helps you leverage grid infrastructure for efficient energy distribution, while energy trading maximizes financial benefits through market participation.

Understanding Energy Trading in the Power Sector

Energy trading in the power sector involves the buying and selling of electricity to optimize supply and demand balance, often through spot markets or long-term contracts. Power wheeling refers to the transmission of electricity through the grid from one location to another, enabling the delivery of traded energy across regions. Understanding these concepts helps you effectively navigate market dynamics and enhance your energy procurement strategies.

Key Differences Between Power Wheeling and Energy Trading

Power wheeling involves the physical transfer of electricity through transmission networks from a generator to a consumer, utilizing third-party grid infrastructure under regulatory agreements. Energy trading refers to the buying and selling of electricity contracts or commodities in wholesale markets to capitalize on price fluctuations without necessarily involving direct physical delivery. Understanding these key differences helps you navigate regulatory, operational, and financial aspects within power markets effectively.

Regulatory Framework and Market Structure

Power wheeling involves the transmission of electricity across different regional grids under strict regulatory frameworks that govern grid access, tariffs, and cross-border wheeling agreements, ensuring efficient utilization of transmission infrastructure. Energy trading operates within organized markets or bilateral contracts, subject to market regulations designed to maintain transparency, competition, and price discovery, often influenced by regional or national energy policies. Your strategic decision between power wheeling and energy trading depends on understanding these regulatory environments and the market structures that dictate operational flexibility and financial viability.

Benefits of Power Wheeling

Power wheeling enables the transmission of electricity from a generator to a distant consumer through a third-party grid, providing enhanced grid flexibility and optimizing resource utilization. This process reduces transmission costs and losses by allowing direct energy flow without the need for new infrastructure investments. Your business benefits from improved energy access, cost savings, and increased integration of renewable power sources through efficient power wheeling arrangements.

Advantages of Energy Trading

Energy trading offers significant advantages, including increased market flexibility and the ability to capitalize on price fluctuations across regional grids, unlike power wheeling which primarily focuses on direct transmission of electricity. You can optimize your energy portfolio by buying low and selling high in competitive markets, enhancing profitability and risk management. This approach also facilitates access to diverse energy sources, promoting sustainability and cost efficiency.

Challenges and Risks in Power Wheeling

Power wheeling faces challenges such as regulatory complexities, transmission congestion, and high wheeling charges that impact cost-effectiveness. The risks include potential transmission losses, grid reliability concerns, and disputes over tariff policies between different utilities. Your ability to navigate these risks depends on comprehensive planning and understanding of regional grid regulations.

Challenges and Risks in Energy Trading

Energy trading faces challenges such as market volatility, regulatory uncertainties, and counterparty risks that can affect pricing and contract enforceability. Unlike power wheeling, which involves the physical transmission of electricity through third-party grids, energy trading entails financial transactions requiring robust risk management strategies to mitigate price fluctuations and credit exposure. Managing these risks effectively is essential for your trading operations to ensure profitability and compliance.

Future Trends: Power Wheeling vs. Energy Trading

Future trends in power wheeling emphasize expanded grid interconnections and increased cross-border electricity flow, enabling more efficient use of renewable energy resources. Energy trading is evolving with advanced digital platforms and AI-driven analytics to optimize market operations and price forecasting. Your strategic choice between power wheeling and energy trading will depend on regulatory developments and the integration of decentralized energy systems.

Power wheeling vs Energy trading Infographic

libmatt.com

libmatt.com