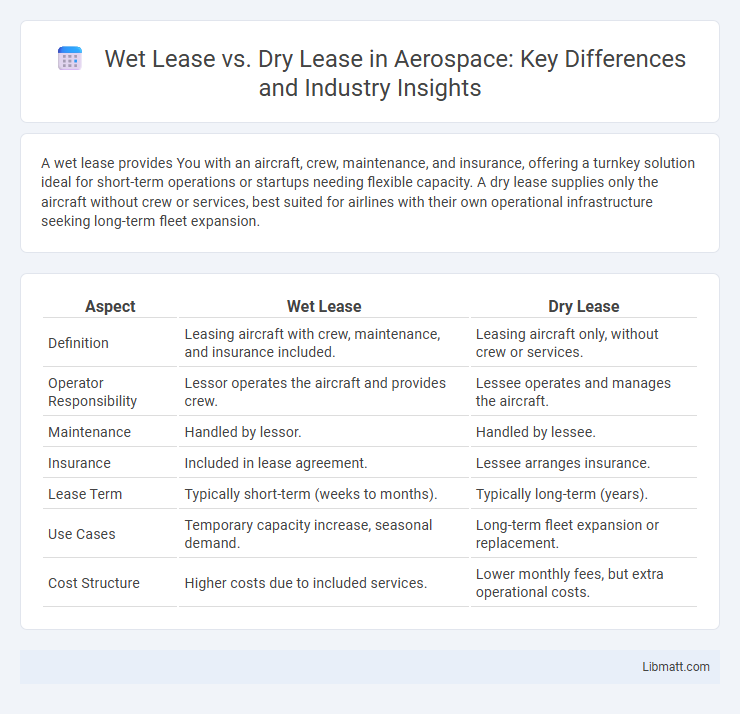

A wet lease provides You with an aircraft, crew, maintenance, and insurance, offering a turnkey solution ideal for short-term operations or startups needing flexible capacity. A dry lease supplies only the aircraft without crew or services, best suited for airlines with their own operational infrastructure seeking long-term fleet expansion.

Table of Comparison

| Aspect | Wet Lease | Dry Lease |

|---|---|---|

| Definition | Leasing aircraft with crew, maintenance, and insurance included. | Leasing aircraft only, without crew or services. |

| Operator Responsibility | Lessor operates the aircraft and provides crew. | Lessee operates and manages the aircraft. |

| Maintenance | Handled by lessor. | Handled by lessee. |

| Insurance | Included in lease agreement. | Lessee arranges insurance. |

| Lease Term | Typically short-term (weeks to months). | Typically long-term (years). |

| Use Cases | Temporary capacity increase, seasonal demand. | Long-term fleet expansion or replacement. |

| Cost Structure | Higher costs due to included services. | Lower monthly fees, but extra operational costs. |

Introduction to Aircraft Leasing: Wet Lease vs Dry Lease

Aircraft leasing is a crucial strategy for airlines to optimize fleet management without the heavy capital investment of purchasing aircraft. Wet lease agreements include the aircraft, crew, maintenance, and insurance provided by the lessor, enabling quick operational deployment and flexibility during peak demand or operational disruptions. Dry leases involve leasing only the aircraft, requiring the lessee to manage crew, maintenance, and insurance, typically used for long-term fleet expansion or replacement.

Defining Wet Lease: Features and Components

A wet lease involves leasing an aircraft along with its crew, maintenance, and insurance, providing a comprehensive operational package to the lessee. The lessor retains responsibility for the aircraft's airworthiness, while the lessee manages scheduling and route planning, enabling flexible and efficient use without direct operational burdens. Understanding these features helps you determine whether a wet lease aligns with your airline's capacity and service requirements.

What is a Dry Lease? Key Characteristics

A Dry Lease involves the rental of an aircraft without crew, maintenance, or insurance, placing operational responsibilities on the lessee. Key characteristics include long-term agreements, cost efficiency for operators with their own crews, and flexibility in fleet management. Your business gains control over flight operations while avoiding ownership expenses under a Dry Lease arrangement.

Differences Between Wet Lease and Dry Lease

Wet lease involves leasing an aircraft with crew, maintenance, and insurance provided by the lessor, allowing the lessee to operate flights without managing operational responsibilities. Dry lease provides only the aircraft for a specified period, requiring the lessee to handle crew, maintenance, insurance, and operational control. These distinctions impact cost structures, regulatory compliance, and operational flexibility for airlines.

Cost Comparison: Wet Lease vs Dry Lease

Wet lease agreements generally incur higher costs due to the inclusion of aircraft, crew, maintenance, and insurance, making them a more comprehensive but expensive option. Dry leases, involving only the aircraft without crew or services, offer a more cost-effective solution for airlines equipped to handle operational expenses independently. Airlines must assess operational capacity and budget constraints to determine whether the higher upfront and operational costs of wet leasing outweigh the lower, more flexible costs of dry leasing.

Operational Control and Responsibilities

Wet lease agreements transfer operational control to the lessor, providing aircraft, crew, maintenance, and insurance, while the lessee handles commercial activities like ticket sales. Dry leases grant you control over operations, as you are responsible for providing your own crew, maintenance, and insurance, managing the aircraft independently. Understanding these distinctions is crucial for determining your level of responsibility and operational oversight in aviation leasing.

Regulatory and Compliance Considerations

Wet leases require less regulatory burden on your operational certifications because the lessor provides aircraft, crew, maintenance, and insurance, maintaining compliance with their own certifications. Dry leases place the regulatory responsibility on the lessee, who must ensure their own Air Operator Certificate (AOC), crew licensing, maintenance programs, and regulatory approvals are fully compliant with aviation authorities. Understanding these distinctions is critical for managing operational risks and adhering to international and national aviation regulations.

Pros and Cons of Wet Lease Arrangements

Wet lease arrangements offer the advantage of including crew, maintenance, and insurance, reducing operational burdens and allowing you to quickly expand capacity without investing in aircraft ownership. However, wet leases typically come at higher rental costs and less control over crew management and scheduling flexibility. This arrangement suits businesses needing short-term solutions but may not be ideal for long-term cost-efficiency and operational autonomy.

Advantages and Disadvantages of Dry Lease

Dry lease offers advantages such as reduced operational costs and increased flexibility for lessees, who provide their own crew, maintenance, and insurance. It allows airlines to maintain greater control over flight operations and brand consistency, making it ideal for long-term use. However, disadvantages include higher responsibility for operational management and the need for extensive expertise, which can lead to increased liability and risk for the lessee.

Choosing the Right Lease: Factors to Consider

When choosing between a wet lease and a dry lease, key factors include your operational capabilities, regulatory compliance, and cost considerations. A wet lease provides a complete package with aircraft, crew, maintenance, and insurance, ideal if you lack experienced personnel or want immediate operational readiness. Your decision should also weigh the lease duration, control over operations, and flexibility requirements to ensure alignment with your business goals.

Wet Lease vs Dry Lease Infographic

libmatt.com

libmatt.com