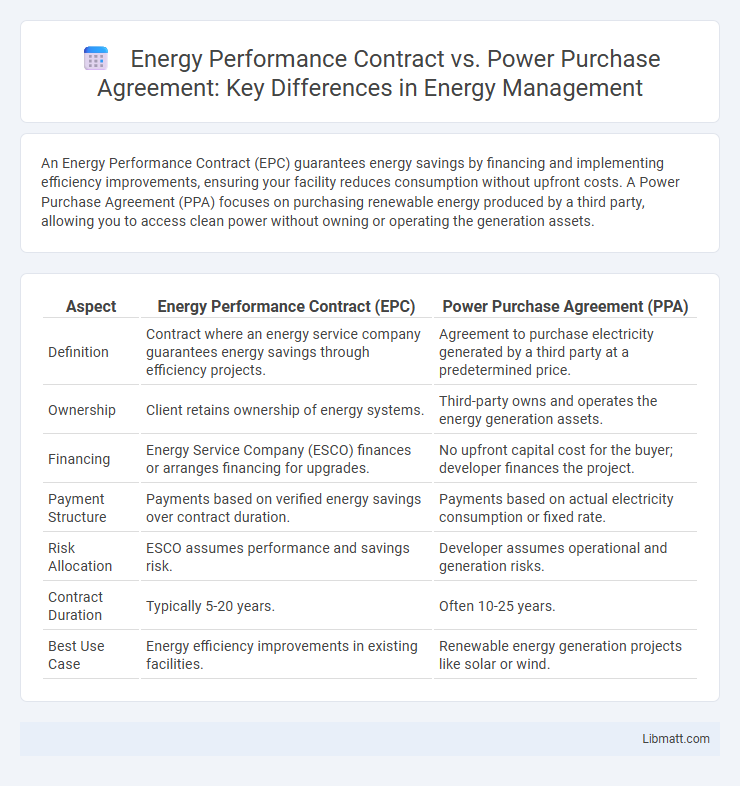

An Energy Performance Contract (EPC) guarantees energy savings by financing and implementing efficiency improvements, ensuring your facility reduces consumption without upfront costs. A Power Purchase Agreement (PPA) focuses on purchasing renewable energy produced by a third party, allowing you to access clean power without owning or operating the generation assets.

Table of Comparison

| Aspect | Energy Performance Contract (EPC) | Power Purchase Agreement (PPA) |

|---|---|---|

| Definition | Contract where an energy service company guarantees energy savings through efficiency projects. | Agreement to purchase electricity generated by a third party at a predetermined price. |

| Ownership | Client retains ownership of energy systems. | Third-party owns and operates the energy generation assets. |

| Financing | Energy Service Company (ESCO) finances or arranges financing for upgrades. | No upfront capital cost for the buyer; developer finances the project. |

| Payment Structure | Payments based on verified energy savings over contract duration. | Payments based on actual electricity consumption or fixed rate. |

| Risk Allocation | ESCO assumes performance and savings risk. | Developer assumes operational and generation risks. |

| Contract Duration | Typically 5-20 years. | Often 10-25 years. |

| Best Use Case | Energy efficiency improvements in existing facilities. | Renewable energy generation projects like solar or wind. |

Introduction to Energy Performance Contracts (EPC)

Energy Performance Contracts (EPC) are agreements where service providers implement energy-saving measures and guarantee cost reductions, with payments tied to achieved energy savings. EPC projects often involve comprehensive energy audits, retrofit installations, and ongoing energy management, ensuring optimized facility performance without upfront capital expenditure by clients. Unlike Power Purchase Agreements (PPA), EPCs focus on improving energy efficiency within existing infrastructure rather than procuring new energy generation.

What is a Power Purchase Agreement (PPA)?

A Power Purchase Agreement (PPA) is a contractual arrangement where a developer finances, installs, and operates an energy system on a customer's property, selling the generated electricity at a predetermined rate. PPAs enable organizations to access renewable energy without upfront capital expenditure, reducing energy costs and carbon footprint. This model is distinct from an Energy Performance Contract, which focuses on guaranteed energy savings through efficiency improvements rather than electricity sales.

Key Differences Between EPC and PPA

Energy Performance Contracts (EPC) guarantee energy savings through efficiency improvements funded by the service provider, with repayment tied to realized savings, whereas Power Purchase Agreements (PPA) involve purchasing energy generated by a third-party renewable system at a fixed rate. EPCs focus on reducing energy consumption within existing infrastructure via upgrades, while PPAs emphasize procuring clean energy without upfront capital investment in generation assets. Contract duration in EPCs aligns with payback periods for implemented measures, typically 5-15 years, whereas PPAs often span 10-25 years for renewable energy supply.

Financial Models: EPC vs PPA

Energy Performance Contracts (EPCs) utilize a financial model where energy service companies (ESCOs) fund energy efficiency upgrades and repayments are made through the energy cost savings realized by the client. Power Purchase Agreements (PPAs) operate on a model where a developer finances, builds, and operates an energy generation system, selling the electricity produced to the client at an agreed rate. EPCs focus on guaranteed savings from reduced energy use without upfront capital, whereas PPAs provide energy supply with fixed pricing but require contract terms tied to energy production and consumption levels.

Risk Allocation in EPC and PPA

Energy Performance Contracts (EPC) allocate performance risk to the contractor, who guarantees energy savings and assumes responsibility for design, installation, and maintenance, minimizing financial risk for the facility owner. In contrast, Power Purchase Agreements (PPA) transfer operational and market risks to the energy provider, who owns, operates, and maintains the energy system while the off-taker commits to purchasing electricity at a predetermined rate. EPC risk allocation focuses on achieving guaranteed energy efficiency outcomes, whereas PPA risk allocation centers on reliable energy supply and price stability over the contract term.

Contract Duration and Flexibility Comparison

Energy Performance Contracts (EPCs) typically span 5 to 20 years, offering moderate flexibility in adjusting project scope and energy-saving measures during the contract term. Power Purchase Agreements (PPAs) often extend 10 to 25 years, with less flexibility as they primarily focus on fixed energy pricing and delivery commitments. Your choice depends on preference for contract adaptability versus long-term price stability.

Suitability for Different Sectors and Projects

Energy Performance Contracts (EPCs) suit public sector projects and facilities aiming for energy efficiency improvements without upfront capital expenditure, ideal for government buildings, schools, and hospitals. Power Purchase Agreements (PPAs) are better suited for private sector renewable energy projects where off-takers seek long-term, stable energy supply contracts, commonly utilized by commercial, industrial, and utility-scale solar or wind projects. Selecting between EPC and PPA depends on project size, financing preferences, and sector-specific energy goals.

Ownership and Responsibility Structures

Energy Performance Contracts (EPC) typically assign ownership of energy-saving equipment and responsibility for maintenance to the service provider, ensuring guaranteed energy savings for Your facility. In contrast, Power Purchase Agreements (PPA) involve an external energy producer owning and operating the energy generation system, with the customer purchasing the generated power without asset ownership. These differing ownership and responsibility structures influence financial risk, operational control, and long-term commitment in energy projects.

Impact on Energy Efficiency and Sustainability

Energy Performance Contracts (EPCs) directly enhance energy efficiency by guaranteeing energy savings through retrofit projects and ongoing performance monitoring, leading to measurable reductions in energy consumption and carbon emissions. Power Purchase Agreements (PPAs) primarily support sustainability by facilitating the procurement of renewable energy from third-party providers, enabling organizations to reduce reliance on fossil fuels and lower their carbon footprint without upfront capital investment. Both models contribute significantly to sustainability goals, with EPCs focusing on optimizing existing energy use and PPAs promoting clean energy adoption.

Choosing Between EPC and PPA: Factors to Consider

Choosing between an Energy Performance Contract (EPC) and a Power Purchase Agreement (PPA) depends on factors such as capital investment capacity, risk tolerance, and project scope. EPCs often require upfront capital but guarantee energy savings and performance, while PPAs offer a pay-as-you-go model with no initial costs, transferring operational risks to the energy provider. Evaluating your financial goals, desired control over the energy system, and long-term energy price stability will guide your decision.

Energy Performance Contract vs Power Purchase Agreement Infographic

libmatt.com

libmatt.com