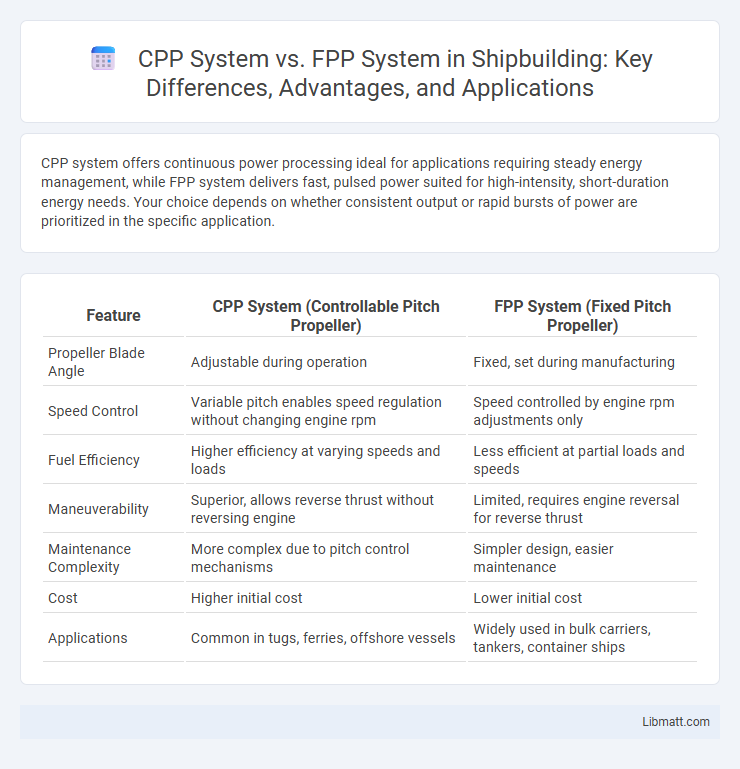

CPP system offers continuous power processing ideal for applications requiring steady energy management, while FPP system delivers fast, pulsed power suited for high-intensity, short-duration energy needs. Your choice depends on whether consistent output or rapid bursts of power are prioritized in the specific application.

Table of Comparison

| Feature | CPP System (Controllable Pitch Propeller) | FPP System (Fixed Pitch Propeller) |

|---|---|---|

| Propeller Blade Angle | Adjustable during operation | Fixed, set during manufacturing |

| Speed Control | Variable pitch enables speed regulation without changing engine rpm | Speed controlled by engine rpm adjustments only |

| Fuel Efficiency | Higher efficiency at varying speeds and loads | Less efficient at partial loads and speeds |

| Maneuverability | Superior, allows reverse thrust without reversing engine | Limited, requires engine reversal for reverse thrust |

| Maintenance Complexity | More complex due to pitch control mechanisms | Simpler design, easier maintenance |

| Cost | Higher initial cost | Lower initial cost |

| Applications | Common in tugs, ferries, offshore vessels | Widely used in bulk carriers, tankers, container ships |

Overview of CPP and FPP Systems

CPP (Centralized Payment Processing) systems streamline financial transactions by consolidating payments through a single platform, boosting efficiency and reducing errors. FPP (Flexible Payment Processing) systems offer customizable payment options tailored to individual business needs, enhancing user experience and adaptability. Understanding the distinctions between CPP and FPP systems helps you choose the best solution for your payment processing strategy.

Historical Background of CPP and FPP

The CPP (Cost Plus Pricing) system originated in the early 20th century during large government contracts in wartime economies, emphasizing reimbursement of incurred costs plus a guaranteed profit margin to ensure contractor participation. The FPP (Fixed Price Pricing) system evolved alongside competitive markets, dating back to the industrial revolution when manufacturers standardized prices to drive efficiency and predictability in supply chains. Both systems reflect historical responses to different economic pressures: CPP addressing risk in uncertain, cost-volatile projects, and FPP promoting cost control and competitive discipline in stable production environments.

Key Principles of the CPP System

The CPP system operates on the principle of continuous, real-time payment processing, ensuring transactions are settled instantly between parties. This system relies on a network of interconnected financial institutions that facilitate the immediate transfer of funds without batch clearing or delays. Key elements include enhanced liquidity management, reduced settlement risk, and the ability to support 24/7 operations, differentiating it significantly from the Fixed Payment Processing (FPP) system, which processes payments in predetermined batches.

Core Features of the FPP System

The FPP (Fixed-Pricing Plan) system offers core features such as predictable cost management, where users pay a set fee regardless of usage, providing financial stability. It includes simplified billing cycles that reduce administrative overhead and enhance budgeting accuracy for businesses. The system also supports customizable plans tailored to specific operational needs, enabling flexibility within a fixed-price framework.

Comparative Analysis: CPP vs FPP

CPP (Centralized Procurement Process) and FPP (Field Procurement Process) systems differ significantly in structure and efficiency, with CPP centralizing purchasing decisions to enhance control and reduce costs, while FPP decentralizes procurement, enabling faster responsiveness and localized vendor management. CPP offers higher consistency in compliance and standardized contracts, whereas FPP allows flexibility and quicker adaptation to field-specific requirements. Choosing between CPP and FPP depends on your organization's priorities, balancing centralized cost savings against the need for operational agility.

Pros and Cons of the CPP Model

The CPP (Certified Payroll Professional) system streamlines payroll processing by ensuring compliance with complex labor laws and reducing errors through automation. Its benefits include improved accuracy, enhanced record-keeping, and better tracking of payroll tax obligations. However, the CPP model can involve higher implementation costs and requires ongoing staff training to maintain system effectiveness.

Advantages and Disadvantages of the FPP Model

The FPP (Fixed Price Project) system offers the advantage of cost certainty, allowing you to budget and plan with a clear understanding of expenses, reducing financial risks for clients. However, the rigidity of the FPP model may limit flexibility, making it challenging to accommodate changes or scope expansions without renegotiation, which can delay project timelines. While FPP provides a straightforward contractual framework, it may lead to compromises in quality or innovation due to the fixed budget constraints.

Implementation Challenges in Both Systems

Implementation challenges in CPP (Centralized Procurement Planning) systems often involve complex data integration, real-time communication issues, and centralized decision-making bottlenecks that slow response times. FPP (Flexible Procurement Planning) systems face difficulties in maintaining supplier coordination, ensuring data accuracy across decentralized units, and balancing adaptability with standardized processes. Understanding these challenges helps you optimize procurement strategies by addressing system-specific vulnerabilities and improving operational efficiency.

Real-World Examples of CPP and FPP Deployment

The CPP (Centralized Power Plant) system is exemplified by hydroelectric projects like the Three Gorges Dam in China, which centralizes electricity generation to serve vast urban and industrial areas efficiently. FPP (Fluctuating Power Plant) systems are demonstrated by decentralized renewable energy setups such as rooftop solar panels in Germany, where power output varies based on environmental conditions and local demand. These real-world deployments highlight the centralized reliability of CPP systems versus the adaptive, localized nature of FPP systems in modern energy grids.

Future Trends and Innovations in Payment Systems

CPP (Centralized Payment Processing) systems are evolving towards integrating AI-driven fraud detection and blockchain technology for enhanced security and transparency. FPP (Federated Payment Processing) systems leverage decentralized ledgers and smart contracts to enable faster, more scalable cross-border payments. Emerging trends highlight the convergence of these systems with digital currencies and real-time analytics to optimize transaction efficiency and user experience.

CPP system vs FPP system Infographic

libmatt.com

libmatt.com