A single bottom chart pattern signals a potential reversal from a downtrend to an uptrend after one significant low, while a double bottom indicates a stronger bullish reversal, confirmed by two distinct lows at similar price levels. To identify whether your investment is stabilizing, observe volume spikes and breakout confirmations corresponding to these patterns.

Table of Comparison

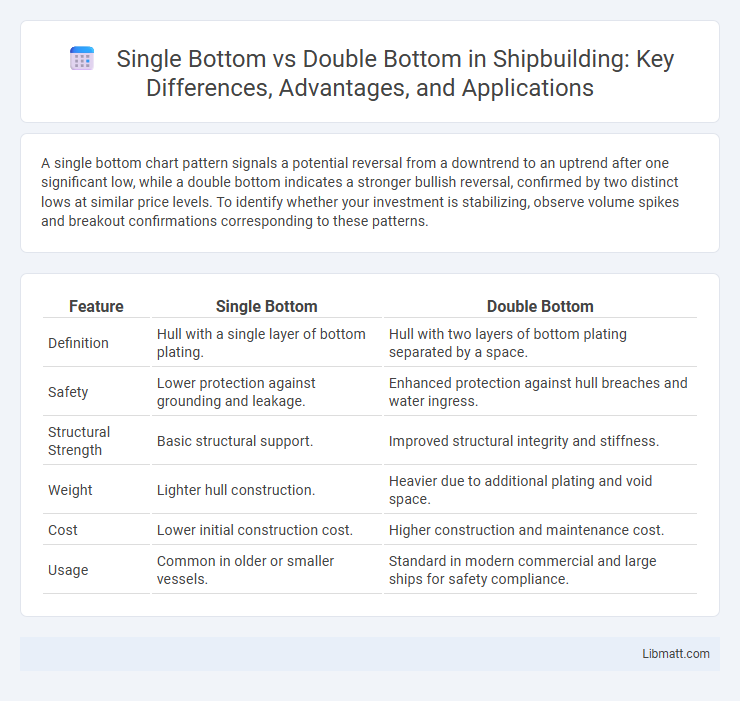

| Feature | Single Bottom | Double Bottom |

|---|---|---|

| Definition | Hull with a single layer of bottom plating. | Hull with two layers of bottom plating separated by a space. |

| Safety | Lower protection against grounding and leakage. | Enhanced protection against hull breaches and water ingress. |

| Structural Strength | Basic structural support. | Improved structural integrity and stiffness. |

| Weight | Lighter hull construction. | Heavier due to additional plating and void space. |

| Cost | Lower initial construction cost. | Higher construction and maintenance cost. |

| Usage | Common in older or smaller vessels. | Standard in modern commercial and large ships for safety compliance. |

Introduction to Single Bottom and Double Bottom Patterns

Single bottom and double bottom patterns are key technical analysis tools used to identify potential trend reversals in financial markets. A single bottom occurs when the price hits a low point once and then reverses upward, signaling possible bullish momentum. In contrast, a double bottom forms when the price makes two distinct lows at approximately the same level, indicating stronger support and a higher probability of a sustained uptrend.

Key Characteristics of Single Bottom

The single bottom pattern features a distinct V-shape with one pronounced trough indicating a potential reversal from a downtrend to an uptrend. This pattern is marked by high trading volumes near the bottom, signaling strong buyer interest and possible price support. Your analysis of a single bottom should emphasize a clear support level and a breakout above the resistance formed between the peak and the bottom.

Key Features of Double Bottom Formation

The double bottom formation is characterized by two distinct low points at approximately the same price level, signaling strong support and potential trend reversal from bearish to bullish. This pattern often features a moderate peak, or resistance, between the two bottoms, confirming market hesitation before upward momentum. Volume typically increases on the rally after the second bottom, indicating buyer strength and further validating the reversal pattern.

Visual Differences Between Single and Double Bottoms

A single bottom pattern features one clear trough followed by a price rise, while a double bottom consists of two distinct lows at approximately the same price level, resembling a "W" shape on the chart. The visual difference lies in the double bottom's confirmation of support, showing stronger potential for trend reversal compared to the single bottom. Understanding these visual distinctions helps you identify key market turning points more effectively.

Market Sentiment and Psychology Behind Each Pattern

Single bottom patterns reflect a market sentiment where buyers gradually regain confidence after a decline, signaling a potential reversal as selling pressure diminishes. Double bottom patterns indicate stronger bullish psychology, showing that buyers have tested support levels twice and rejected further declines, demonstrating increased market conviction. Understanding these patterns helps you gauge when sentiment shifts from bearish to bullish, informing better trading decisions.

Identifying Valid Single and Double Bottoms

Valid single bottoms form when a stock price hits a distinct low followed by a clear reversal indicating strong support, confirmed by increased volume and bullish momentum. Double bottoms require two nearly equal lows separated by a moderate peak, with the neckline break on high volume serving as a critical confirmation signal. Reliable identification involves analyzing price action, volume patterns, and time duration between lows to avoid false signals in trend reversal.

Trading Strategies for Single Bottom Patterns

Trading strategies for single bottom patterns focus on identifying a clear reversal point in a downtrend where price forms a single strong low before moving upward. Investors often use confirmation signals such as increased volume or bullish candlestick patterns to validate the pattern and enter long positions. Your success depends on setting precise stop-loss levels below the bottom and targeting resistance zones to maximize profits while minimizing risk.

Trading Approaches for Double Bottom Patterns

Trading approaches for double bottom patterns capitalize on the bullish reversal signal after a downtrend, confirming when prices break above the resistance level formed by the two lows. Traders often set buy orders slightly above the neckline with stop-losses placed below the second bottom to manage risk efficiently. Volume confirmation and RSI divergence further strengthen the reliability of double bottom patterns as entry points for long positions.

Common Mistakes in Interpreting Bottom Patterns

Misinterpreting single bottom and double bottom patterns often stems from premature entry before confirming the breakout, which leads to false signals and losses. Traders frequently mistake consolidation phases for reversal patterns without sufficient volume confirmation or price action supporting a trend shift. Overlooking the importance of right shoulder symmetry in double bottoms or failing to recognize the single bottom's lack of a second low can cause incorrect trend assumptions.

Conclusion: Which Bottom Pattern Offers More Reliable Signals?

The double bottom pattern generally offers more reliable signals due to its confirmation of a trend reversal after two distinct lows, indicating stronger market support and buyer interest. Single bottom patterns can suggest potential reversals but carry higher risk of false signals since they rely on a single low point. Traders often prefer double bottoms for higher accuracy in predicting bullish trend shifts.

Single bottom vs double bottom Infographic

libmatt.com

libmatt.com