TSMC leads the foundry industry with its advanced 3nm and 5nm chip manufacturing technologies, offering superior yield rates and extensive client partnerships that drive innovation across various sectors. Samsung Foundry competes aggressively by delivering cutting-edge 3nm processes with Gate-All-Around (GAA) transistors, aiming to optimize power efficiency and performance for your high-demand semiconductor projects.

Table of Comparison

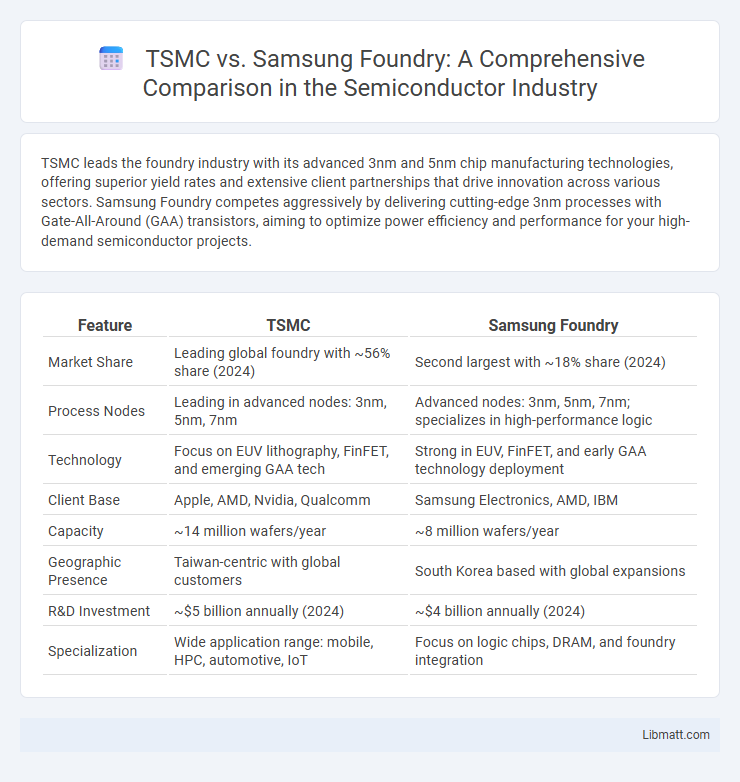

| Feature | TSMC | Samsung Foundry |

|---|---|---|

| Market Share | Leading global foundry with ~56% share (2024) | Second largest with ~18% share (2024) |

| Process Nodes | Leading in advanced nodes: 3nm, 5nm, 7nm | Advanced nodes: 3nm, 5nm, 7nm; specializes in high-performance logic |

| Technology | Focus on EUV lithography, FinFET, and emerging GAA tech | Strong in EUV, FinFET, and early GAA technology deployment |

| Client Base | Apple, AMD, Nvidia, Qualcomm | Samsung Electronics, AMD, IBM |

| Capacity | ~14 million wafers/year | ~8 million wafers/year |

| Geographic Presence | Taiwan-centric with global customers | South Korea based with global expansions |

| R&D Investment | ~$5 billion annually (2024) | ~$4 billion annually (2024) |

| Specialization | Wide application range: mobile, HPC, automotive, IoT | Focus on logic chips, DRAM, and foundry integration |

Overview of TSMC and Samsung Foundry

TSMC, the world's largest semiconductor foundry, leads in advanced process technologies with a strong focus on 5nm and 3nm nodes, serving major clients like Apple and AMD. Samsung Foundry aggressively competes by offering a diverse portfolio from 14nm to cutting-edge 3nm processes, emphasizing integrated solutions including memory and logic. Your choice between TSMC and Samsung Foundry depends on specific process requirements and ecosystem compatibility.

Market Share and Global Reach

TSMC holds the largest market share in the semiconductor foundry industry, commanding over 50% of global capacity, while Samsung Foundry ranks second with around 18%. TSMC's extensive global reach includes advanced fabrication sites in Taiwan and strategic partnerships worldwide, enabling it to serve a broad range of industries and clients. Your choice between these foundries should consider TSMC's dominant market presence and Samsung's strong capabilities in memory integration and cutting-edge node development.

Advanced Process Technologies (3nm, 5nm, 7nm)

TSMC leads the semiconductor industry with its advanced 3nm and 5nm process technologies, widely adopted in high-performance computing and mobile devices, while Samsung Foundry competes aggressively by advancing its 3nm GAA (Gate-All-Around) technology for enhanced power efficiency and transistor density. TSMC's 7nm process remains a key production node, powering numerous flagship chips thanks to its maturity and yield advantage. Your choice between TSMC and Samsung Foundry hinges on specific design requirements, volume needs, and ecosystem support around these cutting-edge process nodes.

Manufacturing Capabilities and Facilities

TSMC leads in advanced semiconductor manufacturing with its extensive 5nm and 3nm node production capabilities, supported by multiple cutting-edge fabs across Taiwan. Samsung Foundry also offers competitive manufacturing prowess, notably with its 3nm GAA technology and diversified global facilities in South Korea and the USA. Both companies invest heavily in expanding capacity, but TSMC's larger production scale and ecosystem partnerships give it an edge in high-volume, cutting-edge chip fabrication.

Key Clients and Strategic Partnerships

TSMC's key clients include Apple, AMD, and Nvidia, leveraging strategic partnerships to dominate the high-performance chip market with advanced 5nm and 3nm process technologies. Samsung Foundry collaborates closely with Qualcomm, Google, and IBM, emphasizing innovation in 3nm and next-generation EUV lithography to expand its footprint in AI and 5G applications. Your choice between TSMC and Samsung Foundry depends on the alignment of their client ecosystems and technology roadmaps with your specific semiconductor needs.

R&D Investments and Innovation Leadership

TSMC leads the semiconductor industry with annual R&D investments exceeding $4 billion, driving cutting-edge process technologies such as 3nm and 2nm nodes. Samsung Foundry follows closely, allocating over $3 billion annually, emphasizing innovation in advanced packaging and EUV lithography integration. Your business benefits from TSMC's consistent innovation leadership, ensuring access to the most advanced manufacturing capabilities and reliable product scaling.

Production Yield and Efficiency Comparison

TSMC consistently achieves higher production yields due to its advanced process control technologies and mature manufacturing ecosystem, resulting in fewer defects per wafer and improved cost efficiency. Samsung Foundry has made significant strides in yield improvement by investing in cutting-edge lithography and automation but still trails slightly behind TSMC in large-scale production efficiency. For your semiconductor projects, choosing TSMC may offer more reliable yield outcomes and optimized manufacturing throughput.

Technological Roadmaps and Future Plans

TSMC leads with advanced 3nm and plans for 2nm process nodes, emphasizing extreme ultraviolet (EUV) lithography and expanding 3D chip packaging technologies to enhance performance and energy efficiency. Samsung Foundry aims to rival TSMC's innovations by accelerating its 3nm gate-all-around (GAA) transistor technology deployment, focusing on next-gen EUV integration and heterogeneous integration for AI and high-performance computing applications. Your choice between TSMC and Samsung Foundry will depend on specific technological roadmap alignment and future scalability needs for cutting-edge semiconductor manufacturing.

Challenges and Competitive Risks

TSMC faces challenges in maintaining its lead in advanced process technology as Samsung Foundry aggressively invests in 3nm and 2nm nodes, intensifying the competitive landscape. Samsung's integrated approach, combining memory and logic manufacturing, poses risks to TSMC's market share in high-performance computing and mobile sectors. Geopolitical tensions and supply chain disruptions further complicate scaling efforts and capital expenditures for both foundries, impacting their global competitiveness.

Impact on the Semiconductor Industry

TSMC dominates the semiconductor foundry market, driving innovation with advanced 3nm and 2nm process nodes that enable smaller, more efficient chips for AI, mobile, and high-performance computing. Samsung Foundry competes aggressively by investing heavily in EUV lithography and diversified manufacturing capabilities, challenging TSMC's market share and accelerating industry-wide technology scaling. Their competition accelerates semiconductor advancements, influencing supply chains, chip costs, and global tech innovation ecosystems.

TSMC vs Samsung Foundry Infographic

libmatt.com

libmatt.com