ETP (Electronic Tolling Program) automates toll payments using electronic transponders, speeding up your travel by eliminating the need to stop at toll booths. RTP (Real-Time Payment) processes transactions instantly, ensuring immediate fund transfers for faster financial operations and improved cash flow management.

Table of Comparison

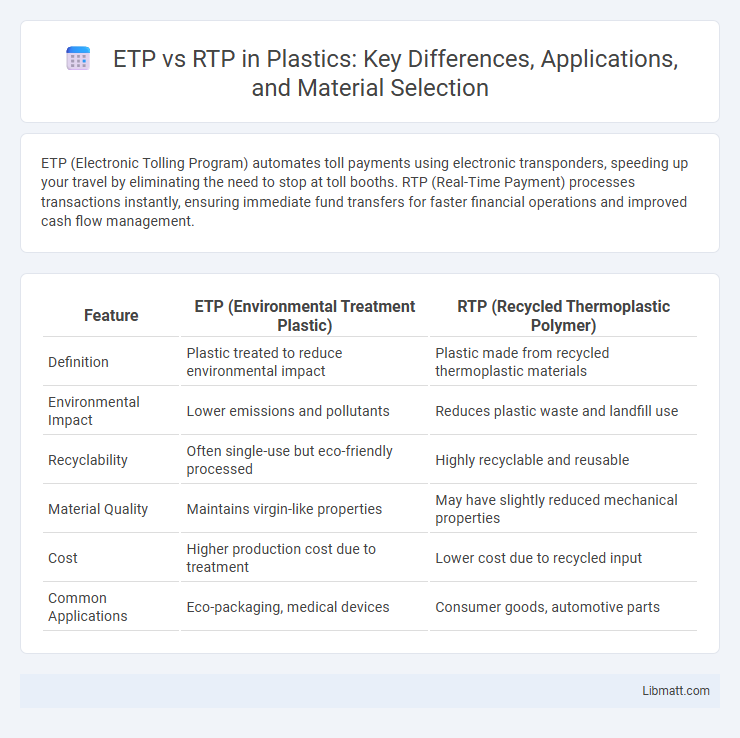

| Feature | ETP (Environmental Treatment Plastic) | RTP (Recycled Thermoplastic Polymer) |

|---|---|---|

| Definition | Plastic treated to reduce environmental impact | Plastic made from recycled thermoplastic materials |

| Environmental Impact | Lower emissions and pollutants | Reduces plastic waste and landfill use |

| Recyclability | Often single-use but eco-friendly processed | Highly recyclable and reusable |

| Material Quality | Maintains virgin-like properties | May have slightly reduced mechanical properties |

| Cost | Higher production cost due to treatment | Lower cost due to recycled input |

| Common Applications | Eco-packaging, medical devices | Consumer goods, automotive parts |

Overview of ETP and RTP

Electronic Trading Platforms (ETP) enable the buying and selling of financial instruments through computerized systems, offering increased speed, transparency, and access to global markets. Real-Time Payments (RTP) systems facilitate instantaneous fund transfers between bank accounts, providing 24/7 availability and immediate settlement. Both ETP and RTP leverage advanced technology to enhance efficiency, but while ETP is centered on securities and asset trading, RTP focuses on rapid payment processing.

Key Differences Between ETP and RTP

ETP (Electronic Toll Payment) systems automate toll collection via transponders and RFID technology, enabling vehicles to pass toll points without stopping, while RTP (Real-Time Payment) involves immediate electronic funds transfer between bank accounts, facilitating instant payments. ETP is primarily used in transportation infrastructure for toll management, whereas RTP serves broader financial transactions across banking platforms. The key difference lies in ETP's focus on toll automation and vehicle identification versus RTP's emphasis on instant money transfer and payment settlement.

How ETP Works

ETP (Electronic Toll Pricing) operates by using electronic tags or transponders installed in vehicles that communicate with tolling systems via radio frequency identification (RFID) or dedicated short-range communication (DSRC). When your vehicle passes through a toll plaza, the system automatically detects the transponder, records the vehicle's entry and exit points, and deducts the appropriate toll amount from a prepaid account or linked payment method. This seamless process eliminates the need for cash transactions, reduces congestion, and enables faster toll collection compared to traditional methods like RTP (Real-Time Payment).

How RTP Operates

Real-Time Payments (RTP) operate through a centralized, always-on network that enables instant clearing and settlement of transactions between banks. Funds are transferred and made available to recipients within seconds, supported by real-time messaging that confirms payment status instantly. This continuous processing model contrasts with traditional Electronic Transfer Payments (ETP), which often rely on batch processing and delayed settlement periods.

Benefits of ETP

Electronic Trading Platforms (ETP) offer enhanced market access and greater liquidity compared to Real-Time Payments (RTP) systems, enabling faster and more efficient trading of financial assets. ETPs provide advanced analytics, automated order execution, and reduced transaction costs, improving overall investment strategies and portfolio management. The use of ETPs supports transparency and regulatory compliance, contributing to a more secure and reliable trading environment.

Advantages of RTP

Real-Time Payments (RTP) offer immediate fund transfers and settlement, providing enhanced cash flow management for businesses and consumers. RTP systems support rich data exchange, enabling improved transaction transparency and reconciliation. The 24/7 availability of RTP increases payment efficiency and reduces processing risks compared to traditional Electronic Transfer Payments (ETP).

Use Cases for ETP

ETP (Electronic Trading Platforms) are widely used in financial markets for executing high-volume transactions with reduced latency and enhanced price transparency. They facilitate algorithmic trading, allowing institutions to efficiently manage large order flows across multiple asset classes such as equities, forex, and derivatives. ETPs serve critical roles in institutional trading, market making, and arbitrage by providing access to real-time market data and advanced order types.

Applications of RTP

Real-Time Payments (RTP) facilitate instant fund transfers and settlement, making them ideal for urgent bill payments, person-to-person transfers, and emergency disbursements in sectors like healthcare and insurance. Unlike Electronic Trading Platforms (ETP), which focus on trading securities and financial instruments, RTP systems support applications requiring immediate liquidity and real-time transaction confirmation. You can leverage RTP for seamless payroll processing, e-commerce transactions, and government benefits distribution, ensuring funds are available instantly without delays.

Security Considerations: ETP vs RTP

Security considerations for Enhanced Transport Protocol (ETP) emphasize robust encryption standards and advanced authentication mechanisms to safeguard data integrity and confidentiality. Real-Time Transport Protocol (RTP) typically relies on Secure Real-Time Transport Protocol (SRTP) extensions to provide encryption and message authentication, addressing vulnerabilities in real-time media streaming. ETP offers integrated security features designed for high-assurance environments, whereas RTP security often depends on supplemental protocols and configurations to mitigate potential threats.

Choosing Between ETP and RTP

Choosing between ETP (Electronic Trading Platform) and RTP (Real-Time Processing) depends on your business needs for transaction speed and efficiency. ETP offers streamlined online trade execution, ideal for bulk order processing, while RTP ensures immediate transaction finality, critical for time-sensitive payments and fund transfers. Evaluating your priorities in automation, speed, and settlement will guide you toward the best solution for your financial operations.

ETP vs RTP Infographic

libmatt.com

libmatt.com